April Notes From The Trenches

Welcome friends! While we – like all content producers – are counting the minutes until we’re inevitably replaced by ChatGPT, we thank you for continuing to support a newsletter that, for now anyway, remains neither “A” nor particularly “I.” We appreciate it.

Before we get into the usual fare, including our latest investment, let’s check on the state of the startup/VC world in the opening quarter of 2023. As always, these numbers (unless otherwise specified) come from the indispensable Pitchbook-NVCA Venture Monitor.

The Reckoning Continues

Those of you who caught our deep dive on publicly traded SaaS companies in our March newsletter will probably recall that the overall financial condition of venture-backed IPOs of the past few years was surprisingly ugly. Add to that the broader softness in public markets, and it shouldn’t be terribly surprising that the IPO market, which made up an outsized share of exit activity over the past few years, is leading an overall slowdown now.

We’re on pace to see the lowest exit count since 2012 (that 2023 number above is annualized), coming in about a third lower than the prior 5-year average exit count. One potential bright side is the median exit value, which appears to have bounced back from last year’s sharp drop, though the sample size is quite small, with only 27 of this quarter’s 227 exits reporting a deal value, so take that with a grain of salt for now.

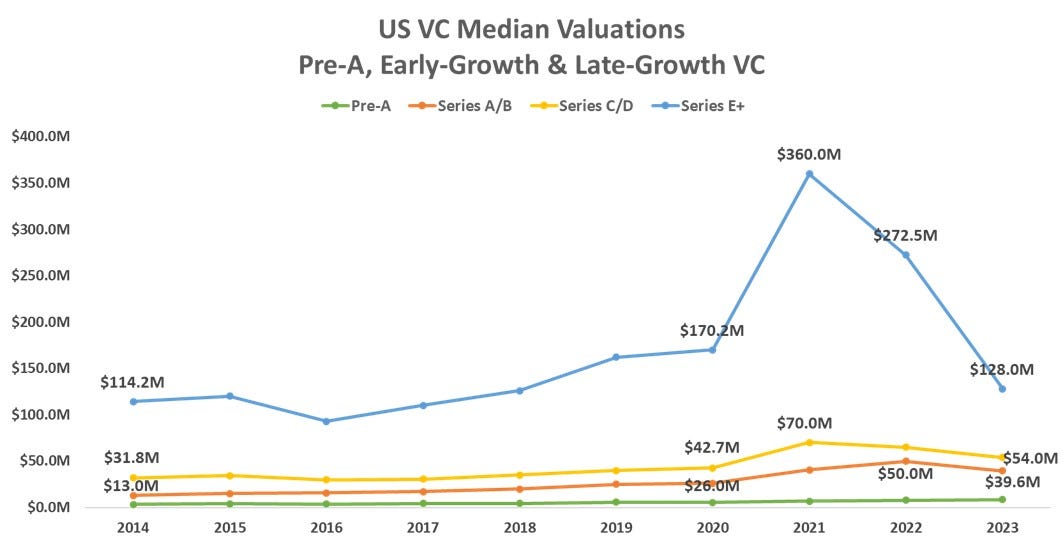

Similarly, median funding valuations at nearly every round are down sharply from the previous few years. The reset has been a bit less extreme (so far), which makes sense when you consider those setting prices in funding rounds are inside the ecosystem and are more anchored to prior year multiples and forecasts, whereas those setting exit prices will be more in sync with current public market metrics.

Don’t Let the Door Hit Your SPAC on the Way Out

Well, that didn’t take long. While it’s not terribly surprising that SPACs have officially gone the way of tulips, beanie babies, and pets.com...

… even the most cynical will surely be surprised by just how poorly the SPACs that did manage to complete mergers (what the kids call “DeSPACing”) have performed.

(I had to go to an alternative source for this one, so the next two charts are from SPACInsider.)

These results have us at an uncharacteristic loss for words, as it’s hard to wrap your head around just how bad this performance has been. Even by post-bubble sell-off standards, this is exceptionally poor.

In fairness, the numbers probably look better if you exclude the vehicles sponsored by the hosts of the All-In Podcast; sadly, we couldn’t find that breakout, but here’s hoping you didn’t trade in your NFT collection for shares of Virgin Galactic. That said, with hundreds (yes, hundreds) of SPACs having already returned all of their capital, uninvested, a diversified SPAC investor might actually make out better than the average late-stage venture LP.

SPACs are unlikely to die entirely (after all, you can still buy synthetic CDOs if you’re so inclined), but chances are their days of mattering are behind us.

So… Is The Sky Falling?

It depends on which part of the sky you’re under.

Exit Market

We’re clearly in a bit of an exit lull. This could simply be the market taking a breather after the frenetic pace of the past couple of years, or it could be the impact of the rapid valuation reset that’s taking place, with buyers looking for steep discounts and sellers anchored to prior years’ multiples (likely some combination of the two), but it’s almost certainly temporary.

The short-term direction from here is anyone’s guess, but the business case for startup acquisition hasn’t changed, and deep, liquid markets like this always find their new clearing price eventually, so we expect a bounce-back before too long.

Startup Funding & Valuations

On the one hand, it’s been a pretty orderly reset thus far, much more so than it was on the way up. The funding tranche seeing the sharpest decline (Series E+) has only reset to levels that we really shouldn’t have departed from to such an extreme degree in the first place (if only someone had picked up on this at the time…), and overall, the degree to which valuations are resetting at each funding stage appears to be tracking the degree to which these stages were overbought (i.e., the later the stage, the bigger the drop), which suggests the market is actually acting rationally for a change.

Late-Stage Correction

On the other hand, we wouldn’t want to be LPs in any of the late-stage mega funds right now, as evidenced by Tiger Global’s ever-growing dumpster fire. Normally we wouldn’t offer up a single firm’s performance as an industry-wide indicator, but Tiger was in well over half the late-stage companies funded in 2021 (no, really, CB Insights reported that they invested in 328 companies in 2021 alone, and the Venture Monitor shows 595 total Venture Growth rounds in 2021). So, it stands to reason that Tiger’s late-stage peers are all in a similar boat.

Further to this, the recent sharp drop in late-stage deal funding, coming while VCs sit on record levels of unspent capital, foots with market chatter we’re hearing, that late-stage managers are earmarking substantial portions of their remaining funds to shore up portfolio companies that continue to burn cash at a rapid pace. Coupled with additional anecdotes we’ve heard that paint a rather bleak picture of institutional LPs’ ratio of cash-to-unfunded commitments, this market segment may get worse before it gets better.

The C2V Zone

In our corner of the ecosystem (pre-Seed through Series A/B), things are tighter than they were two years ago, but to a much (much) lesser degree:

In contrast to recent Seed round data in the Venture Monitor (curiously showing Seed valuations up quite a bit of late — unclear what’s driving that), we’re seeing a market that is softer, though only slightly (having been essentially flat for the prior 4 to 5 years).

From what we’ve seen of Series A and B trends, the range of revenue traction VCs are requiring has narrowed (i.e., no more reaching for companies who are clearly too early) and we’re seeing a stricter adherence to more traditional revenue multiples (i.e., crazy outlier valuations are gone), but there are still plenty of VCs actively deploying capital on reasonable terms, and for companies that are executing well, it’s more or less business as usual.

The biggest change we’ve observed is for those companies needing to raise while still in the no man’s land between rounds (for example, a company that is clearly more mature than a typical Seed but short of the revenue range for Series A). Whereas two years ago, it was relatively easy to find new external money to fill out whatever portion of a bridge round wasn’t taken up by existing investors, it is exceptionally difficult to do so today, so we would highly encourage founders to consistently (and honestly) update projections and if needed, look to raise bridge money well before you hit those critical final few months of runway.

We’ll see where things go from here, but there is something to be said for not having chased a clearly overheated market, even if we were in a near-constant state of Will Farrell at the end of Zoolander for a solid 18 months there.

Our Latest Investment - ePallet

Our second marketplace! As we noted in our January newsletter, the new company we featured then (Eze), was our first marketplace out of nearly 40 companies, and now we have our second in ePallet, a B2B marketplace for the wholesale food industry. Not surprisingly, both markets suffer from similar high-level issues that make them prime candidates for a digital marketplace solution.

The wholesale food industry is currently dominated by distributors who sit between manufacturers (e.g., General Mills, Campbells, Frito-Lay, etc.) and end customers in industries like hospitality, facilities services, grocery, etc. These middlemen buy in pallet-sized quantities and move products to their own warehouses, from which they ship to customers.

For smaller customers (e.g., individual restaurants), distributors provide real value in their ability to mix and match sub-pallet quantities of different items from their inventory as needed; however, for customers who buy in pallet-sized quantities (an $860 billion market), distributors are mainly a hinderance, adding cost and inefficiency, and little to no additional value.

While this is widely recognized by pallet-sized buyers and sellers, they have struggled to build direct relationships, as sellers lack transparency into the customer side of the market (distributors having deliberately kept them in the dark about who is actually buying their products) and customers have been deterred by the time and cost required to establish and manage relationships with the wide variety of suppliers most require.

ePallet’s marketplace solves these problems by providing a forum for buyers and sellers to find each other and transact directly, with ePallet handling payments and logistics (via automated routing to pre-vetted third party freight providers) at a 20 – 35% lower price than current distributors.

Run by an impressive team with extensive backgrounds in grocery, food distribution, digital commerce, and supply chain software, the company already has a significant presence in several markets, with more than a hundred manufacturers and customers already running around $1mm of transactions through ePallet each month, and we look forward to helping them scale from here.

In The Trenches

FaceTime

In March and April, Chris focused on Founder and Investor catch-up meetings. Solid conversations were covering next-step strategies, problem-solving, and a sprinkle of Chris’s wisdom.

(Left to right: Shai Goldman | Brex, Nick Jordan | Narrative, Patrick O’Leary | Boostr

(Left to right: Jenny Fielding | Everywhere Ventures, Ari Paparo | Launch Science, Vivian Graves | Otis, Allison Goldberg | SVP & Managing Partner, Comcast Ventures and Startup Engagement)

PR for Startups

Chris met with Mark Naples from WIT Strategy to talk about PR for startups. Mark shares his thoughts on outdated industry trends and what founders should be looking for in a PR firm.

Portfolio Highlights

Watch The CivDot+ In Action

Marking coordinates with 3/100' (8mm) accuracy and only one operator. Its onboard speaker guides the operator with the point description (in this case, telling it to mark with Blue / White nails and whiskers). This highly precise autonomous layout tool is ideal for construction projects with tight tolerances.

Automation Is Here To Solve Your Problems

Join host Matt Sprague with guest Tom Yeshurun, Founder & CEO, to hear how Tom’s obsession with precision has placed @civrobotics on the cutting edge. CIV Robotics’ customers use automation for everything they can, including: -Automating smaller, annoying tasks that no one likes to do -Using robot-level precision to reduce waste and increase profit -Dealing with labor shortages, especially in remote job locations in the solar industry.

Autonomous trucking – and related insurance – still down the road

The expectation that by now we’d all be whizzing around in self-driving cars – texting, reading, or snoozing while being autonomously delivered to our destination – hasn’t really lived up to predictions. A similar hope for an automated trucking industry is also in abeyance as we wait for technology to catch up.

Travel Industry Podcast Ad Spending Takes Flight, Doubling From January To February.

The travel industry appears to be banking on a more normal season this year after the pandemic sidelined a lot of travelers. “We saw spending jump pretty significantly in February,” Magellan AI CEO Cameron Hendrix says. On his company’s monthly update detailing the biggest podcast ad spenders, Hendrix said spending jumped 111% between January and February. That differs from last year, when travel industry spending on podcasting was roughly the same during the two months.

Even as 22 new travel brands were detected by Magellan AI for the first time last month.

Driver Technologies and TomTom Digital Cockpit Partner to Keep Drivers Better Protected and Our Roads Safer

Driver Technologies, Inc., an AI-based mobility tech company that delivers a safer driving experience, and TomTom(TOM2), the geolocation technology specialist, today announced a partnership to implement the premium version of the Driver app into the TomTom Digital Cockpit for OEM car makers.

"This partnership with TomTom represents Driver Technologies' expansion into the OEM market," said Rashid Galadanci, CEO and Co-Founder of Driver Technologies. "TomTom is the perfect partner as it integrates various innovative apps within its Digital Cockpit platform that will help bring the automotive industry one step closer to providing video and telematics data for personal use, coaching, fleets, and insurance companies worldwide."

Driver Technologies and Getaround Announce Pilot Program to Provide Users with Dash Cam & Safety Features

Driver Technologies, Inc., an AI-based mobility tech company that delivers a safer driving experience, and Getaround (GETR), the world's first connected carsharing marketplace, today announced a pilot program that will offer drivers of shared vehicles in San Diego, Los Angeles, San Francisco, Portland, and Seattle free access to dash cam technology and safety features.

Read the full article.

Electric Growth: Birmingham-Based Condoit Raises Seed Round As EV Charging Needs Grow

Birmingham founder Ian Hoppe says we’re living during a “Gold Rush” era of electrification. And that means big business for his startup Condoit, an energy management tool. Because amid this electrification gold rush, Hoppe said Condoit is “selling shovels.”