August C2V Notes From The Trenches

Welcome friends! We hope you’re all enjoying your last few weeks of summer and appreciate you taking a break from the beach to spend some time here in the trenches. We have a new investment to share, as well as several open roles in some of our best companies (yes, there are startups still hiring!) and a new video from our robotic bathroom cleaning company, Somatic, which is about as cool as anything we’ve seen in our many years in this space.

But first, a look at the…

State of Venture: Mid-2023

Overall, VC markets remain in post-bubble recovery mode — funding activity continues to be slow, while valuations and exits have seen a bit of bounce, but remain well below the peak. Since not much has changed in the headline numbers from our last update, we’re going off-script a bit and taking a deeper dive into a couple of trends that have had us a bit puzzled over the past few quarters.

Hoarders: Barely Alive

One of the only late-stage VC metrics that hasn’t followed the ubiquitous bubble/crash pattern is Unallocated Capital, which has consistently accumulated at around a 20% annual pace since 2017. This pace of growth remained steady throughout the bubble, despite record-shattering startup funding (the $500B+ shelled out in from Jan 2021 through June 2022 was more than double any 18-month period prior to 2021) and — so far anyway — has continued at the same pace, even as VC fundraising has fallen off a cliff.

The result is that VC dry powder ($280 billion as of 12/31/2022) is now more than 4.5x the capital deployed by VCs in the peak bubble years of 2021 and 2022, and more than 8x the pre-bubble five-year average. Of note, after capturing a historically large (90%+) share of overall VC funding since 2020, this available capital is nearly all sitting in late-stage funds, so when we’re discussing VC behavior and funding rounds below, we’re mainly referring to startups and funds at Series C/D and later.

So why aren’t late-stage VCs spending, even after a massive drop in valuations? We have some theories.

Bubble PTSD

Having fully lost their grip on reality for a solid three to four years, this fund segment is sitting on portfolios that, if truly marked-to-market, are likely at least 50% underwater (probably worse for many), and that’s assuming their companies all survive.

Furthermore, the sheer fact that so many managers were perfectly happy to throw money at 50-100x revenue multiples shows that they either A) lack a fundamental understanding of how to properly value companies, or B) were just chasing momentum (the old “buy high, sell higher” strategy, which works great… until it doesn’t). These managers are now either at a loss as to what went wrong/how to fix it (having not understood why it was working in the first place), or have thrown in the towel entirely (having lost their ability to offload overpriced deals into an overpriced IPO market).

As a result, many late-stage VCs are now simply gun-shy.

Price Discovery Stalemate

Late-stage founders are contributing at least somewhat to this slowdown as well, whether its companies pulling out all the stops to avoid raising down-rounds, or companies looking to raise at post-Series A/B/C stages for the first time and simply not liking the revenue multiples on offer (note to founders out there: this is one of the many reasons that capital efficiency should be your core guiding principle — with low or zero burn, you always have the option to simply walk away from a market you don’t like).

Down Rounds & Pay-to-Play/Cram Downs

It should come as no surprise to you regular visitors to the Trenches that just about every late-stage startup who is back in market today, having last raised in the 2020 – 2022 period (at valuations that seemed utterly insane, even in real time), are having to accept substantial valuations hit in order to raise fresh capital (so-called “down rounds”).

The severity of this funding crunch is escalating quickly. We’ve seen a dramatic rise in so-called “Cram Down” or “Pay-to-Play rounds” (down rounds that also include highly punitive conditions for existing investors who choose not to participate). These can range from forced conversions of shares from preferred to common (thereby moving non-participants to the bottom of the liquidation stack) to forced conversions that also include a partial forfeiture of shares.

This latter concept can be particularly harsh. We’ve seen deals with terms as punitive as a 10:1 conversion for non-participating investors, meaning any investor who doesn’t contribute at least their pro rata share of the new round receives 1 common share for every 10 preferred (yes, you read that correctly, a forfeiture of 90% of the shares of non-participating investors).

While we don’t have macro numbers on pay-to-play rounds, Carta’s data shows a sharp climb in down rounds over the past 5 quarters (to 20% of all funding rounds this year), and it’s like there are many more to come given the staggering pace at which many of these bubble-funded companies were burning cash.

This leads us to believe that quite a bit of this late-stage VC cash hoarding is due to funds reserving capital to either keep portfolio companies afloat or at least avoid large dilutions and/or punitive reclassifications of their shares, which is further supported by the fact that 87% of total VC dry powder is in funds raised at the top of the bubble, from 2020 through early 2022 (i.e., those whose likely bought into every one of their portfolio companies at peak valuations).

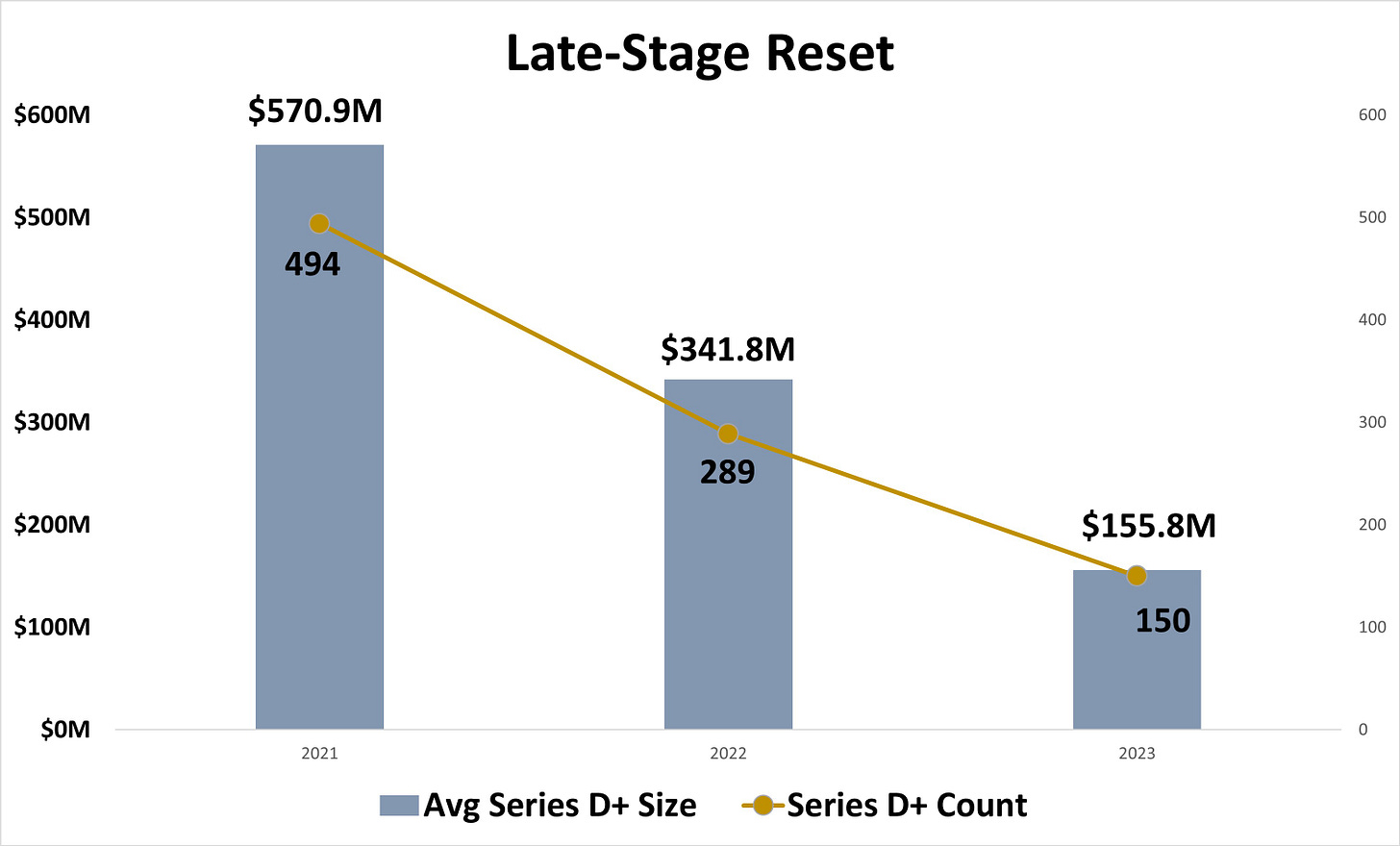

The upshot of all of this is that late-stage venture funding has gone off a cliff. Through the first half of 2023, we’re on pace to see a 70% drop in Series D and later rounds from the 2021 peak, and a 73% drop in the average size of these rounds.

Seed Disconnect

The other trend we’ve been unable to reconcile is the reported climb in Seed valuations which, according to the latest data from both the Venture Monitor and Carta, continues unabated.

This is particularly puzzling to us, as it’s our core area of focus and is inconsistent with what we’re seeing on the ground. Our overall average Seed entry points have been more or less flat since we launched Fund I in 2019 (within a very narrow +/- 10% band year-to-year). If anything, we’re seeing a much softer market on a traction-adjusted basis (still workshopping that term).

Some of this is undoubtedly a result of sampling factors:

These are broad averages from the US as a whole and not all regions apply the same rigor to their valuation assessments (cough… Bay Area… cough, cough)

Both Carta and the Venture Monitor go strictly by what a round is called, in funding docs (Carta) and public announcements (VM), so there are almost certainly rounds in these datasets that are Seed in name only. For example, more than 22% of the “Seed” deals included in the VM data over the past 18 months were rounds larger than $5mm, including 87 “Seed” deals of more than $25mm. In what world deals of this size are considered Seed, we don’t know, but it’s not the one we live in.

That said, we also suspect there may be another phenomenon impacting Seed pricing (and this is something we do see in our portfolio). There is a lot of chatter in the press and elsewhere that early-stage startups may be bootstrapping longer before seeking venture money, and we’ve seen this in the form of several companies over the past year or so raising seed rounds with far more customer and revenue traction than is typical at this stage, including two with 7-figure-plus ARR run rates at the time we invested.

These more mature companies do tend to command somewhat of a valuation premium compared to average Seed companies (though on a risk-adjusted basis, we would argue they’re trading at huge discounts) and this could be part of the valuation increases being recorded by the data aggregators. It would also help explain the drop in Seed deal volume over the past several quarters, which is considerably steeper than we’d expect (2023 is on pace for the lowest Seed deal count in 10 years) given that the early-stage market generally stayed out of the 2020/21 FOMO frenzy that ensnared late-stage managers.

New Investment

The legal tech space is one that we’ve long seen as a great fit for our core thesis, with a huge underlying sector that is hundreds of years old, but only grows in relevance over time, and has barely scratched the surface of technological innovation. But it’s also a historically challenging market in which to find saleable SaaS products, as one of the two primary customer segments (law firms) are also one of the few corporate verticals whose fee structure provides disincentives to increasing labor productivity.

So we’re all the more pleased to announce our second foray into the legal tech space with Brief Catch, our latest Fund II investment (joining pro bono program administration and marketplace SaaS company, Paladin, from our first fund).

BriefCatch is a legal writing SaaS platform that provides real time legal draft editing suggestions for navigating intricate rules and enhancing arguments, using natural language processing and a proprietary database of more than 11,000 legal rules and writing suggestions. Each suggested edit is accompanied by explanations for how it can enhance an argument, along with real world examples of where the suggested language has been used in a similar context by the world’s best legal writers (Supreme Court justices, etc.).

Founded by, Ross Guberman, one of the foremost experts in legal writing (as well as a best-selling author on the subject), the company has a significant competitive advantage in the database he has compiled from his years in the field, as well as his credibility within legal circles, which it is further leveraging by incorporating generative AI capabilities into expanding its database and subject matter capabilities.

While perhaps not obvious to the non-lawyer, the product provides tangible (and substantial) ROI to law firms, the largest of whom write off upwards of $700mm per year in associate time attributed to drafting issues and spend millions more on legal writing seminars and consultants.

While it’s still one of the tougher verticals to sell into, we think BriefCatch is well positioned to scale in what is one of the largest TAMs out there.

C2V Watercooler

The Cunninghams take on Portugal! We hope you are having a good summer break.

We also updated our website to prepare for the busy season ahead, so check out the refreshed C2V website.

Chris spent time chatting with Luke Lambert about the disconnect of founders using trending terminology to mask the problem the business is solving. You can check out the full podcast episode here.

Portfolio Highlights

Somatic Goes Viral - Toilet cleaning robot makes us feel better about all this AI business

It can get us down watching AIs learn to write music, poetry, and technology news, but watching this clever autonomous toilet-bot mop up the bogs somehow makes it all worthwhile. It's good to know robots are coming for the crappy jobs too.

Somatic’s latest video released on YouTube went viral on LinkedIn and X (1 and 2). The robot now operates without a Somatic handler on-site.

Meet Olive, Your AI-Powered Digital Transformation Coach

Exciting news for Olive Technologies. Its AI-powered digital transformation coach is now available to the public.

With Olive, you can skip weeks of project planning and create a thorough evaluation plan with use cases, requirements, vendor lists, discovery questions, and more in minutes. And the best part? You can chat with her right from our website!

Our extensive experience and powerful AI tools will help you achieve faster decision-making, cost-effective evaluations, swift requirements consensus, optimized business analyst workflow, and make your entire organization digital transformation experts.

Disrupting Trash

Bradley talks to Meredith Danberg-Ficarelli and Laura Rosenshine, co-founders of WATS, about using software to solve the thorniest of human problems. "Our careers are garbage," says Danberg-Ficarelli, "we're proud of that."

The intersection of politics, technology, and regulatory issues has never been as energized as it is now. Bradley Tusk talks with the most influential investors, policymakers, and entrepreneurs about the latest venture, tech, and political trends.

Driver Technologies and Métrica Móvil Partner to Expand Driver Safety Solutions to Fleets in Latin America

This new partnership will help address the inequality in access to new vehicles equipped with safety technology, as the average age of a car on the road is over 12.5 years old. Driver's non-hardware solution will help fleets to manage their vehicles better by empowering fleet owners with data while preserving their privacy based on which information drivers want to share with their employers, family, or insurance company.

"Driver Technologies provides a scalable, easy-to-install, and low-cost alternative option to expensive hardware, which is a perfect solution for our fleet customers," said Gerardo Ortiz, IoT Manager at Métrica Móvil.

Boostr Rebrands Website

Boostr has refreshed and upped its website game this month. You can check out their new look here.

Trucking MGA Koffie partners with Snapsheet as it looks to bring claims in-house

Koffie Financial has teamed up with fellow insurtech Snapsheet in a strategic partnership that it says will improve the MGA’s claims function as the trucking specialist also looks to bring claims in-house.

Job Opportunities

Paladin - Business Development Rep

Eskaud - DevOps Engineer

Wats - Senior Product Manager

UpTime Health - Sales Rep, Partner Account Manager