C2V February Notes From The Trenches

Welcome Friends! With February shorting us a couple of days to get the newsletter finished, we’re getting right to it.

In putting together our January newsletter, where we took a high-level look at the 2024 performance of the broader venture and exit markets, we came across a couple of strange and unique sign-of-times phenomena that we felt warranted a closer look.

Startup Funding Concentration

Let’s start with startup funding and, more specifically, where those funds are going.

As discussed in our prior newsletter, total startup investment in 2024 increased for the first time in three years. Every funding stage from Series A to however far into the alphabet we’re going these days showed a year-over-year increase in funding, that Series A+ contingent overall increased 33%, and while Pre-A declined, it was only by 6.5%.

On its face, this would appear consistent with a market on its way back up after a couple of post-bubble reset years (which we’re seeing signs of elsewhere as well). In other words, it aligns with normal market ebbs and flows. But what’s not normal is that a truly incredible 20% ($41 billion) of all startup funding in 2024, and 44% of late-stage investment, went to just five AI-related companies (across seven funding rounds) – Databricks, OpenAI, xAI, Waymo, and Anthropic. If you remove those seven rounds (out of 15,260 on the year), overall startup funding goes from +29% to essentially flat, and Series C+ funding goes from +32% to -7%.

We don’t highlight this to pour cold water on the recovery – the market has improved considerably in the past 12 months – we bring it up because one-fifth of all venture money deployed over 12 months going to 0.05% of funding rounds is a statistical outlier of crazy proportions.

Yes, there is an outsized round or two in nearly every 12-month period, but not like this. In fact, the only year that comes close is last year, when two of these same companies (Anthropic and OpenAI) accounted for 10% of all startup funding.

Bubble 2: AI Boogaloo?

(For the eight of you who got that reference - and maybe chuckled despite yourselves - obviously, this writer-reader relationship was just meant to be).

Of course, this begs the question (which has been the subject of much industry debate for the better part of the past two years): Is this the next big thing or another bubble? And the answer most likely is… yes.

First, a quick look at the aforementioned big AI companies, why they might need such huge sums of money, and why they may or may not warrant the incredible valuations attached.

Do the Dollar Amounts Make Sense?

Yes, more or less. Unlike most (all?) of the SaaS companies who dominated late-stage funding in the 2019/20/21 bubble years, the business models of foundation-layer GenAI companies are inherently capital-intensive, requiring massive amounts of data, computing power, and engineering/data science staff. Could they be more efficient with all this money? Probably, but we’re at least in the ballpark of plausibility this go-around.

That said, the concentration in these companies within VC portfolios looks like it may be a departure from prior years/strategies (potentially in a big way). While ~30% of the funding for these outlier rounds came from Google, Microsoft, and Amazon (for whom these kinds of numbers are basically rounding errors), the remaining ~$30 billion came from VCs, and while these late-stage funds have gotten really big in recent years, this still seems like an awful lot of eggs in a basket that could be anywhere from the greatest basket ever made to one whose bottom dissolves the first time it rains. More on that below.

Do the Valuations Make Sense?

This is a bit trickier to answer. In addition to the huge range of revenue multiples among companies, the quality/stickiness of this revenue and the sustainability of current growth trajectories are harder to gauge from here in the cheap seats. With the caveat that specifics on these rounds and company financials are sparse, all second-hand (press releases and journalists citing sources), and occasionally conflicting (so every number below comes with a “according to what we’ve read” qualifier) here’s what we found:

As you can see, these multiples are all inflated to some degree (public SaaS companies are currently averaging around 7x revenue), but is that justifiable? Well, here’s our quick and dirty take, based on minimal information and 10 minutes of analysis (i.e., a grain of salt might not be enough):

Databricks

This valuation actually seems pretty reasonable:

While above market at 20x, it’s in line or below most other high-growth companies and way below some of the names out there that still seem to be trading purely on FOMO

80%+ gross margins (way above most public SaaS companies of recent IPO vintages)

At or very near positive cash flows while still growing at more than 60% annually

Waymo

Maybe a little excessive, but we get it:

10x TTM revenue growth; TBD if that’s sustainable, but even at half that pace, this revenue multiple is in the 30s by December

Massive, obvious, and easily quantifiable upside, based on years of rideshare demand, pricing, and price elasticity data courtesy of Uber

Unlike Uber, which keeps around 20 – 25% of what its customers spend, Waymo gets to keep all of it (eventually; in theory).

Anthropic, OpenAI, xAI

This is where we start to get a little into fantasy land

Compared to the others on this list (and the overall SaaS market), OpenAI’s multiple doesn’t seem crazy…

… except that it’s not a SaaS company. Sure, they charge a subscription, but the economics are entirely different, annual losses continue to exceed revenues and don’t seem to be improving even as revenues scale rapidly, and whether that will ever change remains a big unknown (see above re: how expensive it is to run these current LLM models).

And if rumors are true, they’re on the cusp of raising a $40 billion round ($40 billion!) at a $300 billion valuation (double where they were priced 3 months ago)

Anthropic – ditto all of the above, but with a worse multiple

xAI – possibly a cheaper to build/maintain model (using large amounts of synthetic data for training), but at an Elon-cult premium even less defensible than Tesla’s. Also, it’s apparently trained on Twitter data, so pretty good chance it ends up being the absolute worst fake human on the planet.

We have no doubt the VCs in these companies took an extremely thorough, measured, reasoned approach to these investments, and they could very well turn out to be big winners. At the same time, though, this is a brand new market that is barely understood at this point (not just use cases and monetization, but the tech itself, which is very much still at the “throw a bunch of stuff and the wall and see what sticks” stage), and the market will almost certainly look dramatically different in 5 - 10 years, if not sooner.

We’ve previously compared the LLM space to cloud computing (suggesting it may also evolve into an oligopoly) due mainly to the similarly large amounts of capital needed to reach and sustain the necessary scale, as well as the potential of being the foundation on which all GenAI software is built (hence being called “foundation models”). But given the relative complexity and newness of the tech involved, it may also behave more like search; not in the sense that we expect to end up with one dominant player, but that the version of the tech that ultimately emerges as the winner could take quite a while to sort itself out.

The first ten years or so of the search market were incredibly fluid, with market leaders changing constantly and no one grabbing a particularly meaningful share and holding it for long. Of the top five companies in 1994 (equivalent timeframe to LLMs today), only three remained five years later, and only one made it ten years (this is a great visualization of that period and beyond). We wouldn’t be surprised to see something similar (or perhaps even more dramatic) play out here. In fact, we’d be more surprised if the current LLM leaderboard had the same players on it in three years than if it had none of them.

This is not to say that VCs shouldn’t be making bets on how they think this will play out, that’s what we do, after all. But what we also do is make asymmetric bets (i.e., small downside, huge upside), and that’s what VCs did with search companies in the mid-90s. Even adjusted for inflation, these companies raised money in the tens of millions (in total, across all rounds), with private valuations low enough that companies could IPO at valuations well under $1 billion and still generate double-digit multiples for investors at all stages.

Not only are these current AI companies priced to absolute perfection, the pace at which they continue to raise new capital means that even investors getting in at relative “bargains” (e.g., Anthropic at $15 billion a year ago vs $60 billion today) will be so diluted by the time they exit, they’ll need trillion-dollar-plus IPOs just to generate 10 - 20x returns, never mind the kind of homerun you need to return a fund where some of these 9- and 10-figure bets end up at zero. For context, there are currently 18 companies on the entire planet trading at $1 trillion-plus market caps, and none of them (excluding state-owned oil companies) IPO’d anywhere close to those levels.

If you don’t believe us, look no further than the continuing phenomenon of multi-billion-dollar IPOs, in which late-stage investors are lucky to break even.

Dear LPs: Good News & Bad News…

There are definitely some low moments for every VC, but it’s hard to imagine anything worse than having to write an email to LPs explaining that your portfolio company just had one of the 45 largest tech IPOs ever... and you lost money on it (as happened to late-stage investors in Instacart a year and half ago, which we wrote about at the time), and a close second would be breaking even on such an IPO, which is what happened with Service Titan’s Series F – H investors.

That IPO came in well below the private valuations at all three rounds, but all three included a “rachet” that effectively allowed them to be bought out at cost if the subsequent round (or IPO) came in below the price they paid. A smart inclusion by these investors to be sure, but only something you can generally get away with in distressed markets, and in any event, a 1x return in venture might as well be a loss (x1,000 if that 1x comes on a multibillion-dollar IPO).

There are quite a few more of these single-digit IRR or worse returns on huge exits in the past couple of years, which we won’t go into (C2V Research is a little understaffed at the moment), but suffice it to say that this is what happens when you indiscriminately overpay for deals, as happened with reckless abandon in 2019 – 2021 (even if you win, you still lose), and those losing funding round valuations sound positively quaint compared with what’s now being paid for these hot AI names.

Our advice? Wait for the initial crash and then sift through the wreckage for the companies that will eventually be the long-term winners. So maybe the historical comp is actually satellite and fiber optic infrastructure in the late 90s? We’ll get this sorted eventually. In the meantime…

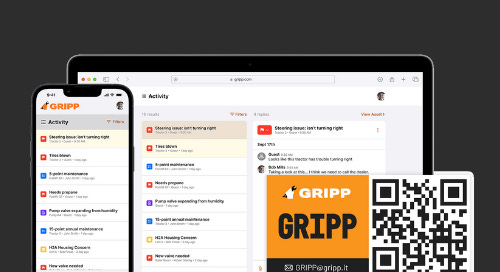

We are pleased to introduce Gripp as the newest investment from our Tributary Fund, reinforcing our commitment to backing transformative solutions in industries often overlooked by traditional venture capital.

Agriculture is a prime example of a dirty, dull, and dangerous industry ripe for technological disruption. Gripp’s platform addresses a critical gap: preserving operational knowledge and improving efficiency in an industry that still relies heavily on fragmented, manual processes.

The funding will support Gripp’s product development, sales expansion, and strategic partnerships, ensuring more farmers benefit from its simple, cost-effective approach to equipment and operations management.

Given agriculture's increasing labor shortages and efficiency demands, we believe Gripp has the potential to become an essential tool on farms across America.

Gripp has already received multiple industry recognitions, including Top Producer Summit’s Farmer’s Choice Award, CropLife’s Best Ag Apps of 2025, and the $100K top prize at the Farm Bureau Ag Innovation Challenge—a testament to its immediate impact.

We’re excited to support Gripp’s mission and look forward to seeing its continued growth in the agricultural sector.

Sales Continue to be Underappreciated for Early-Stage Startups.

While everyone talks about AI and product fit, the real game-changer in startups is a robust sales structure. Many overlook this critical component—but it’s crucial for driving scalable revenue. Watch Chris’s latest video.

Establishing a reliable waste data baseline

WATS worked with a real estate owner and developer with over 70 million ft² of office space across 158 sites in the US and Canada.

Waste management and sustainability are important to them, and they have been working to improve the accuracy and management of their waste data.

SendTurtle is on ProductHunt

Phalanx.io is asking for support in voting for their product, SendTurtle, on Product Hunt. Please help by sharing and casting your vote here.

5 Best Autonomous Robots for Construction Sites

In a recent article by Unite.AI, Civ Robotics is highlighted for its innovative autonomous solutions in the construction industry. Their flagship products—CivDot, CivDot+, and CivDot Mini—are designed to enhance precision in construction layouts. Notably, the CivDot Mini can autonomously mark up to 17 kilometers of continuous and dashed lines daily with sub-inch accuracy, significantly streamlining tasks like parking lot layouts. These advancements position Civ Robotics as a leader in automating and improving efficiency on construction sites.

A new milestone for #CivDot! Robot #21 has officially marked 4,147 points in a single day—an incredible achievement for autonomous land surveying technology.

Here’s to setting new records and continuing to build the future!

Driver Technologies Becomes the Preferred Safety Technology Provider of Brazos

Driver Technologies has partnered with Brazos Specialty Risk Insurance (BSR) to provide its AI-powered video safety solution to commercial fleet drivers, offering insurance discounts and enhanced road safety. The partnership enables full HD video recording, cloud storage, and AI-driven driver scoring to improve fleet management.

How Computer Vision Enhances Grid Reliability and Resilience

In this IoT For All Podcast episode, Chris Ricciuti, Founder & CEO of Noteworthy AI, discusses how computer vision and AIoT are transforming utility grid management. He explores utilities' challenges, such as aging infrastructure and extreme weather, and how AI-powered smart cameras mounted on fleet vehicles help improve grid reliability, safety, and efficiency. The episode also offers insights into the future of AIoT and practical advice for organizations looking to adopt these technologies.

Cracking the Code: How Startups Can Win with MSP Partnerships

In Episode 57 of The Pair Program, Tim Winkler and Mike Gruen chat with Brian Luckey (CIO at Integris) and Ian Y. Garrett (CEO of Phalanx) about how startups can successfully partner with Managed Service Providers (MSPs) to scale. They discuss what MSPs look for in vendor solutions, the role of automation and AI in cybersecurity, and common mistakes startups make when pitching to MSPs. If you're in tech or cybersecurity, this episode is a must-listen!

Otis Pet is hiring a Founding Engineer.