C2V January Notes From The Trenches

Welcome Friends! We had planned a snappy intro on what to look for from the macro and tech/venture worlds in 2023, but we decided to shelve it as:

This is about as hard a year to handicap as we can remember. We’ve seen most of these macro phenomena before, but not for a long time and never all at once.

Our best guesses are mostly pretty gloomy, and that’s no way to start a year. Also, Chris wouldn’t let Matt do 400 words on the macro parallels to Mr. Burns’s having every disease known to man (and whether that would actually make the economy similarly indestructible), so I guess we’ll just move on to the more professional content…

Taking the Temperature of VC (Sort of)

In an effort to be more organized about sharing deals with our fellow venture investors, we’ve asked a group of our peers to submit their investment parameters for collection in our database, with some interesting, encouraging, and unexpected results. While this is by no means an exhaustive market survey, with 50 investors now in the database, we’re at least knocking on the door of statistical relevance.

The full data series can be found here, with some highlights below.

People still invest in early-stage companies

While institutional money flow trends of the past several years have dramatically swung toward late-stage venture, it’s nice to see we still have plenty of company here in the Seed & Pre-Seed markets:

Nearly all respondents do at least some investing at Seed, and 60% do some pre-seed funding as well.

Even more importantly, this isn’t just lip service (i.e., VCs who purport to be “Seed” investors while writing only $10mm+ checks), as more than 2/3s of respondents will make initial investments as small as $500k.

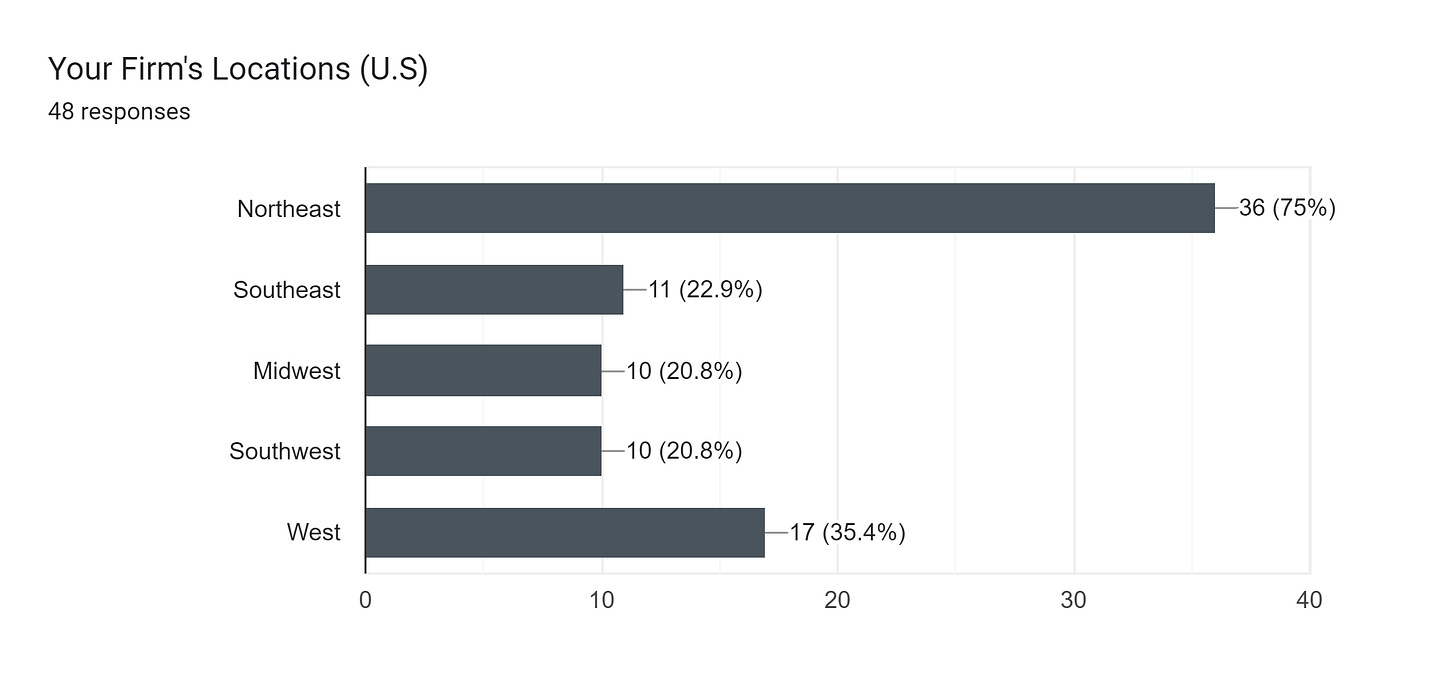

Venture is finally… venturing (sorry, sorry, that was terrible) away from the coasts

While most respondents remain in traditional venture hot spots, 38% had at least one office outside the Northeast and West Coast hubs.

Look at all these coastal elites getting over themselves (and, in fairness, ourselves)! We’re proud of you, VCs!*

*(No, not you, San Fran. Moving to Florida for half the year to dodge taxes doesn’t count)

True impact verticals are finally on the radar (in a big way)

While the vertical focus for our survey cohort was mainly as expected (e.g., FinTech: In; Consumer: Out), we’re pleasantly surprised at the popularity of Clean Tech and MedTech, which are, in our opinion, two of the most important human-impact verticals that also happen to be two of the most problem-laden.

We’ve come a long way from founders of dating apps, step-counters, scooter rental companies, etc., claiming, with a straight face, to be “changing the world.” Keep up the good work, friends!*

*(Still not you, SF. Sorry, but you do this to yourselves.)

New Investment

Nearly 40 companies in, and we finally have our first marketplace! More on why that’s the case below, but first, please warmly welcome our newest portfolio company, Eze, a B2B wholesale marketplace for secondhand electronics.

It seems like we say this a lot, but as far as well-established and massive yet shockingly disjointed and inefficient industries go, the secondhand electronics market is one of the most broken we’ve seen. Despite being an $80 billion business that is 5x the size of the primary electronics market (by volume), the secondhand electronics market is rife with problems.

The primary drivers of these problems are 1) the truly global nature of the market, with tens of thousands of end buyers (i.e., those who sell to local consumers) in more than 100 countries, and 2) a lack of efficient transactional tools leading to more than 90% of distributors conducting sales and logistics via phone calls and messaging apps, resulting in:

A ridiculous layering of fees via the 7 – 9 middlemen involved in the average transaction before goods reach end buyers

Rampant fraud and persistent quality and trust issues

Near zero price transparency (caused both by the varying layers of middlemen and bid processes that are limited to small, private WhatsApp groups)

Eze solves these problems via a global marketplace that allows sellers and end buyers to connect directly while providing price transparency (via centralized bidding), quality control (through a proprietary QA process), and fraud prevention (via a centralized payment process).

With a disproportionately large share of global supply volume already onboarded, Eze is in a much more favorable position than most marketplaces at this stage (hence being the first we’ve backed, though we’ve seen dozens), where they can now spend 80-90% of sales efforts scaling the buy side, something we expect to see them do rapidly in the coming years.

LP Highlights

We are excited to continue spotlighting our LPs this month with four incredible individuals that bring so much value to our C2V portfolio companies.

Why are you passionate about working with our founders?

Jennifer Prince: I was attracted to the C2V founders’ passion and commitment to transparency, staying principled and focused, and prioritizing women and a very diverse group of founders and investors.

Shiven Ramji: I think this comes down to two reasons: the first is that I get to help them scale their businesses by bringing my expertise and experience across a few industries. Second, I love the categories C2V is focused on, and my help can have an outsized impact on companies that are going after established TAMs. Both allow me to accelerate our founders’ journeys to achieve the right outcomes.

Connie Kim-Farina: The C2V founders have their ears to the ground and know the portfolio companies, inside and out. The relationships they forge are true, deep, and wide - they act, in essence, like the connective tissue that enables companies to get to the next level of performance.

Sean Cohan: I’m passionate about partnering with and exchanging ideas with other operators who put in the work, dream about growth and scale, and have similar joy and obsession around what they do every day.

What is the one thing C2V does right when it comes to investing?

Jennifer Prince: They have aggregated an incredible collection of over 125 investors and familiar and respected names in tech, leadership, VCs, athletes, & personalities. C2V differentiates and brings in its investors’ pre-investment while focusing on its founders’ post-investment. I love their operating style and commitment to delivering.

Shiven Ramji: I'd say it’s the maniacal focus on the investment thesis and sticking to that. That singular focus filters the right type of companies we want to work with.

Connie Kim-Farina: C2V focuses on the core assets that drive the business...the people.

Sean Cohan: C2V is built, invested in, and supported by and for leaders, founders, and operators, rather than lifetime observers or investors. They have been there; they are not afraid of gritty, scrappy, and love getting stuff done at maximum speed.

Portfolio Highlights

Blutag launches subscription management via Alexa.

Blutag is now integrated with Recharge! All merchants utilizing Recharge can enable this feature in their Alexa skills. Customers can hear updates on their next shipment, pause, and change the frequency of their subscriptions.

Medmo launched its pilot with Firefly Health to help its members access the best imaging appointments and close the loop on care journeys.