Welcome friends! A belated Happy New Year to you all! Here’s hoping at least one or two of your resolutions remain intact. Sadly, ours (shorter newsletters) is about to go down in flames.

Following up on our 2025 predictions last month, we thought we’d do a quick review of what transpired in the wider venture world in 2024. We realize this is a curious order in which to do this, but unfortunately the 2024 macro wrap up requires actual data (which just came out), unlike with the 2025 predictions, where we just get to make stuff up.

(Note: all data is from the Pitchbook-NVCA Venture Monitor unless otherwise noted)

2024 in a Nutshell

So how did everyone do in 2024? Well, much like the past couple years, it really depends on which part of the market you play in.

Some (like those of us in the Pre-Seed-to-Series B range) are seeing a continuing flow of great new companies at reasonable valuations on the way in, and what looks to us like an increasingly attractive market on the way out.

While others (predominantly late-stage, mega-fund managers) seem to be paralyzed by a lack of liquidity, caused (or so the prevailing narrative goes) by poor market conditions, and extraordinary macroeconomic and geopolitical risks. With exits for these funds few and far between, including some that are exiting below prior funding round valuations even when they do happen, late-stage funds continue sit on record amounts of unspent capital, neither raising nor spending much (without three massive AI deals – Databricks, OpenAI, and Anthropic – that accounted for nearly half of all Series E+ spending in 2024, that segment would be back to 2017 levels)

You may be wondering how the exit market can simultaneously be showing very positive supply/ demand signals and also hopelessly impaired by a historically poor macro environment? It can’t! But we’ll get to that in a bit.

First, a look at the exit market overall.

The State of Venture Liquidity

With the total number of exits more or less flat year-over-year and IPO exits at a decade-plus low, our relative optimism may seem like a reach, but we think the real story is in the valuations at which deals were closing in 2024

While overall exit valuations remain down from the 2021 bubble peak, they are just a shade lower than 2020, the second highest year on record. Furthermore, IPO valuations almost tripled from last year, and are back to 2019 levels, while private equity buyouts were just below their all-time high, and M&A valuations exceeded their previous high by a whopping 61%.

This combination of low volumes and high prices is what makes us so optimistic, as it suggests a market with demand handily outpacing supply (i.e., a seller’s market).

This is also what makes us skeptical of all of the macro doom-and-gloom coming from the late-stage markets as the reason for their lack of liquidity in recent years.

Reasons or Excuses?

Just about every VC-related article you read these days will cite one or more of the following as the reason for the dearth of liquidity in (mainly late-stage) VC funds, and (in our view, anyway) none of them stand up to the least bit of scrutiny.

(Quick note: We are not picking on the intrepid journalists who are writing these pieces – they’re just asking the liquidity question and sharing the answers they’re getting. We are definitely picking on those giving these answers, though.)

The standard reasons given, in no particular order:

Interest rates are too high

There is too much geopolitical risk

Rates are certainly higher than they were a few years ago and what’s happening in the Middle East and Ukraine is inarguably terrible (and potentially destabilizing). But big, broad macro events like this don’t pick and choose specific financial sectors to impact; if they were adversely affecting the general appetite for risk-taking, the NADAQ would not be up 57%, 44%, and 43% since the start of each event, respectively.

The IPO market is closed

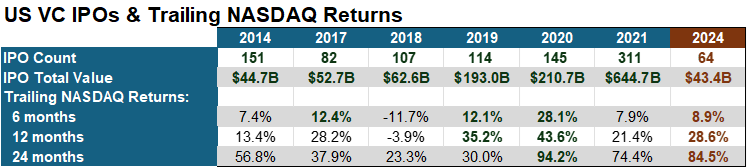

This one feels like they’re not even trying. IPO windows close when stock markets are down, not when they’re up 30% for the year (and 85% over two years). In fact, of the years in which VC-backed IPOs exceeded 2024 (in both number and total value), only one had a better stock market backdrop, as measured by trailing 6-, 12-, and 24-month NASDAQ returns.

Government intervention in the M&A market

With apologies for the lengthier digression, this one requires a bit more of a deep dive. Please bear with us.

On the one hand, it’s hard to find a lawyer, banker, or CFO (regardless of political leaning) who is sad to see Lina Khan go, and there are plenty of anecdotes floating around about potential deals whose sponsors didn’t even bother to file due to expected resistance. So, we feel pretty confident that there has been some regulatory impact on the M&A market, at least on the margins.

On the other hand, whether you look at regulatory “enforcement actions” (deals that are formally challenged by regulators) or “second requests” (deals that haven’t officially been challenged but are facing as much as 6 - 9 months of additional scrutiny), both in an absolute sense and as a share of all pre-merger filings, the overall impact and variance (year-to-year and administration-to-administration) suggest that the overwhelming majority of proposed deals make it through the approval process without a hitch, regardless of who’s calling the shots.

Looking at these past 24 years (the entirety of the last four presidential administrations):

Year-to-year variance:

The share of deals officially challenged has averaged 2.3% per year with a high of 4.3% (2009) and a low of 0.9% (2021).

The share of deals delayed by a second request has averaged 3.0% with a high of 4.5% (2009) and a low of 1.6% (2022)

Administration-to-administration variance:

The share of deals officially challenged has averaged 2.3% per administration with a high of 3.0% (Obama) and a low of 1.3% (Biden).

The share of deals issued a second request has averaged 2.8% with a high of 3.5% (Obama) and a low of 1.9% (Biden).

Impact in the context of overall market activity:

The total drop-off in just VC-backed M&A deals from the 2021 peak to the 2024 low (-524) is roughly equal to 10 years’ worth of delayed, and 14 years’ worth of formally challenged deals across all sectors (not just tech).

In other words, over the past 3 years (post-bubble), 98.2% of deals officially filed for review were approved within the normal 30 – 60 period, and while it’s obviously impossible to quantify the oft-cited deals that were never filed due to fears of a protracted regulatory fight, the total number of these withheld deals would have to be extraordinary in order to have even been a material factor in the overall drop in VC-backed M&A activity, let alone a primary driver.

What’s Really Going On (Probably)

Grain of salt here, as this is of course, highly speculative (though not without plenty of corroborating evidence). We think the real reason late-stage funds aren’t selling is not because they can’t, but because they don’t want to.

Keep in mind that in 2021, these funds were paying absolutely incomprehensible valuations for companies that were burning cash at a never-before-seen pace. When that cash spigot abruptly turned off in early 2022, those that survived (which does appear to be most of them) had to dramatically dial back spending, mostly at the expense of sales and marketing. Already sitting on valuations that were going to be hard to grow into at 2021 spend levels, at these scaled back growth and revenue levels, most of these companies would be lucky to get a market valuation that’s even half of their last funding round even today, three years removed from those last funding rounds.

This, we think, is the real reason we’re not seeing late-stage exits. These funds are the size they are because institutional investors view them as being the safest bets in the space, run by managers with (ostensibly) unimpeachable track records. Posting one or more losing vintages, especially in the largest funds they’ve ever raised (by a mile in most cases) could be disastrous.

One final note on what makes us so confident that most of these companies are massively underwater relative to their most recent funding round marks.

The Secondary Market

One silver lining to the recent investor frustration with a lack of liquidity is the emergence of robust secondary markets. In addition to providing additional liquidity, these platforms also provide price transparency in an otherwise extremely opaque market.

Using 2024 weekly price data from Hiive Markets (one of the larger and more liquid platforms), we see 524 actively traded companies for which Hiive was also able to provide a comparison to the valuation from the most recent private funding round.

Of these 524 companies:

The median trading price relative to prior fundraise valuation was -50%

Only 27 traded at or above their prior funding round at least once, and if that wasn’t grim enough, there were nearly as many companies (25) that traded at a discount of 85% or more at least once.

Again, without extensive insider knowledge of a wide range of portfolios, we can only speculate about the true late-stage exit dynamics. With that said, though, we think the evidence is pretty compelling that we’re headed toward a rising tide here, even if it will only lift a smaller subset of the boats (while the rest continue bailing water like crazy).

New Investment

Our latest investment in our Capital Partners II fund, Cylerity straddles both the fintech and medtech spaces, providing medical service providers with a funding bridge between insurance claim submissions and payments (which can often take up to 3 months). Cylerity uses a proprietary AI model to predict the payment probability of each claim filed with an extremely high degree of accuracy (98.9% across 3.4 billion claims processed thus far). The platform then automatically routes claims that meet its risk thresholds to a third party capital provider who advances a share of the claim (based on the risk profile) to the service provider, and is repaid, plus interest and fees, out of the insurance proceeds 45 - 90 days later.

Customer segments include physician practices, surgery centers, non-emergency medical transportation providers, and hospitals.

C2V Watercooler

If you missed last month’s newsletter, you are in luck. AlleyWatch featured our take in their 2025 Tech Predictions seven years in a row! In the article, we dive into the rise of automation in ‘dirty, dull, and dangerous’ industries, the continued growth of B2B SaaS solutions in underserved markets, and why the Midwest remains a hotbed for innovation. We’re excited to see how these trends evolve over the year and to continue backing the founders who are making it all happen.

Check it out and let us know your thoughts.

Our favorite event of the year is just around the corner! The C2 Ventures Annual LP & Founder Day is an opportunity to bring together our investors, portfolio founders, and team for an afternoon in Midtown Manhattan packed with insights, inspiring stories, and meaningful connections. It’s a celebration of everything we’re building together. The event will feature refreshments, appetizers, and a cocktail hour, with thanks to our incredible partners—Goodwin, Carta, and JP Morgan Chase. If you’re interested in attending, contact us for more details.

Portfolio Highlights

A Look at Utility-Scale Solar Farms Under New Presidency

During Donald Trump’s presidency, despite a focus on traditional energy, utility-scale solar farms experienced significant growth, with over 50,000 MW of capacity added and major projects like Nevada’s Gemini Solar Project approved. Republican-leaning states, including Texas, Florida, and Arizona, became leaders in solar expansion, benefiting from investments, job creation, and local revenue. While federal policies like solar tariffs posed challenges, they also spurred domestic manufacturing. If Trump returns to office, his leadership could further accelerate solar farm development in economically aligned states, bolstering energy independence, rural growth, and America’s renewable energy landscape.

Phalanx Launches Exciting Updates to SendTurtle

Phalanx is excited to announce the launch of a brand-new UI/UX experience on its product, SendTurtle. The latest updates focus on:

✅ Intuitive navigation and streamlined workflows to save time and effort.

✅ Enhanced readability to ensure key information is always readily available.

✅ Optimized for UX to make the experience smoother and more enjoyable.

This redesign is part of their ongoing commitment to provide customers with tools that work better and make their customer’s lives easier.

How Redhand Advisors Scales with Olive

By leveraging Olive's powerful tools, Redhand streamlined processes, enhanced client collaboration, and achieved a remarkable 30% reduction in project delivery time. Learn how this shift toward productized services is driving efficiency and client satisfaction.

Noteworthy AI and UI Partner to Deploy Innovative Grid Inspection Technology across South-Central Connecticut

Noteworthy AI has been awarded nearly $1.8 million to collaborate with United Illuminating (UI) in enhancing Connecticut's electric grid through advanced inspection technology. The project, funded by PURA’s Innovative Energy Solutions program, will deploy Noteworthy's AI-powered smart cameras on UI fleet vehicles to inspect 34,000 utility poles, focusing on underserved communities. The initiative aims to improve grid reliability, reduce outage risks, expedite broadband deployment, and support local economic growth. This partnership highlights the transformative potential of data-driven insights in modernizing utility infrastructure.

Impilo Expands Healthcare Monitoring Capabilities with A&D Medical and PatchRx Integrations and a New ISO 13485 Certification

Impilo has expanded its healthcare monitoring capabilities through strategic integrations with A&D Medical and PatchRx, enhancing its remote patient monitoring (RPM) platform with advanced cellular-enabled devices and medication adherence technology. These innovations aim to improve patient care by enabling real-time data collection and early intervention opportunities. Additionally, Impilo achieved ISO 13485 certification, demonstrating its commitment to quality and regulatory compliance in medical device management. Together, these advancements position Impilo to deliver streamlined, technology-driven patient care solutions and set new standards for comprehensive healthcare monitoring.

Job Opportunities

Civ Robotics has several positions open.

This is a solid reality check on the late-stage VC liquidity excuses. If high interest rates and macro risks were really the main culprits, why are M&A valuations hitting record highs, and why has the NASDAQ been on fire? Feels like some funds are just reluctant to take exits that don’t match their peak 2021 valuations.