C2V July Notes From The Trenches

Welcome Friends! If the recent spike in email auto-replies is any indication, we’ve officially entered the sleepy season, so we appreciate you taking a break from your lounging and day drinking to give us a read.

In that spirit, we’re going USA-Today style this month, with minimal text and lots of charts. So, while we familiarize ourselves with the schedules for various obscure summer Olympic sports (favorites include ping pong, trap shooting, handball, and anything ending with “athalon,” we’re absolutely going to test out whatever “breaking,” “trampoline” and “canoe slalom” are), and fondly remember the great Phil Hartman (RIP)…

Taking the Temperature of VC (part of it, anyway)

In our efforts to remain consistent in sharing deals with our fellow venture investors, we continue to build our VC database with some interesting, encouraging, and unexpected results. While our database (for obvious reasons) is mainly focused on the pre-Seed to Series B crowd, with more than 100 investors now, we think this constitutes a fairly meaningful market survey.

People still invest in early-stage companies

While institutional money flow trends of the past several years have dramatically swung toward late-stage venture, it’s nice to see we still have plenty of company here in the Seed & Pre-Seed markets:

Nearly all respondents invest at least some at Seed, and 60% also invest in pre-seed funding.

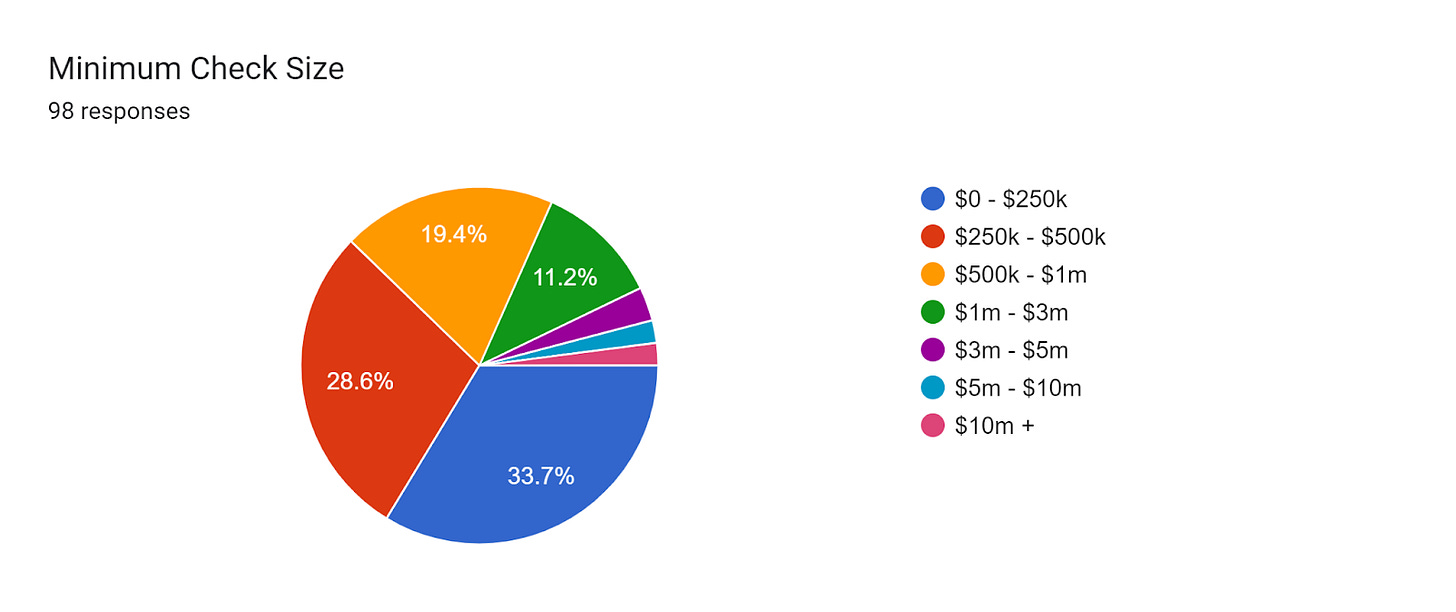

This isn’t just lip service (i.e., VCs who purport to be “Seed” investors while writing only $10mm+ checks), as more than half of respondents will make initial investments of $500k or less.

More importantly, even as the share of groups who will invest in Series A has grown, the percentage of firms who invest in Seed and Pre-Seed has not decreased.

Multi-round investing continues to be nearly a universal strategy

This degree of pervasiveness actually has our contrarian antennae up. I'm not sure we’ll do anything with that, but we’re considering it.

Venture continues to… venture (sorry, sorry, that was terrible) away from the coasts

From our last look at these numbers (about 18 months ago), the coasts have lost about 5%, with the Midwest and Southwest picking up a similar share.

Look at all these coastal elites getting over themselves (and, in fairness, ourselves)! We’re proud of you, VCs! (No, not you, San Fran. Moving to Florida for half the year to dodge taxes doesn’t count).

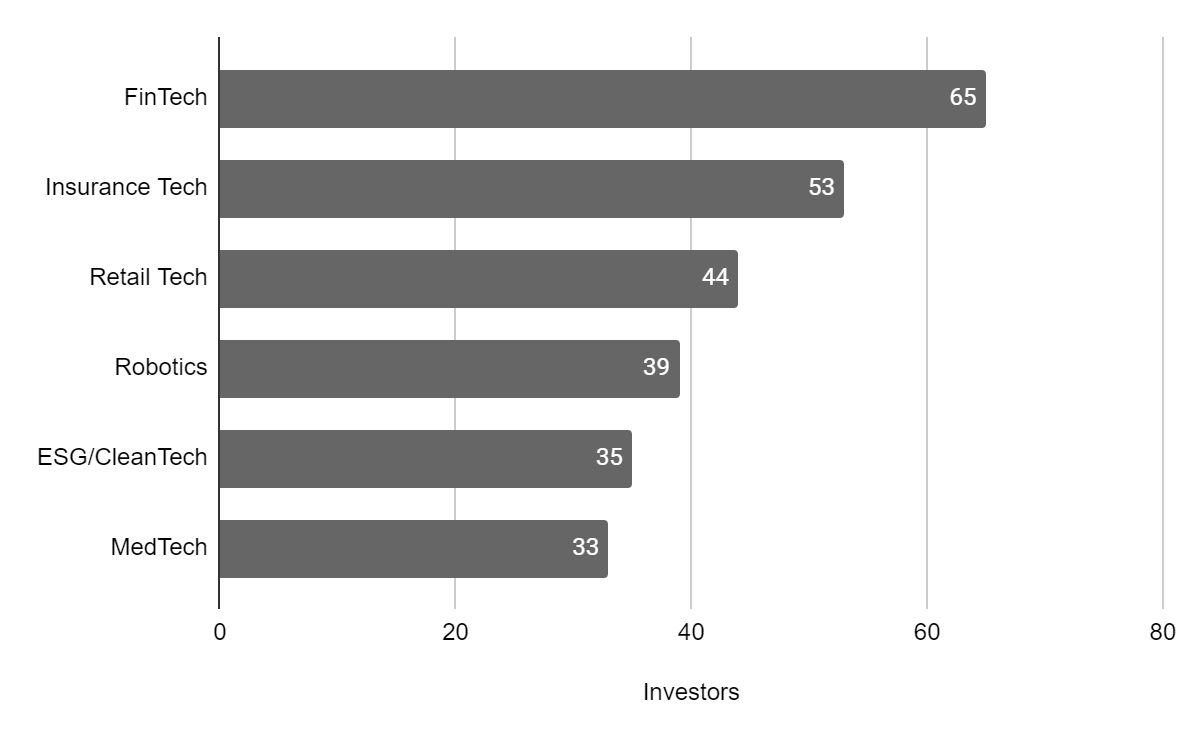

Fintech/Insurtech Continue to Dominate

The financial and adjacent spaces continue to attract the most VC attention, with Insurtech showing the second biggest gain from our prior survey.

What’s incredibly encouraging to see (especially as the rest of humanity becomes increasingly self-obsessed) is the biggest gain coming from the clean tech segment, which increased at around 1.5x the pace of the database overall. Threading the needle between doing a real, tangible service to the world and making money for your investors is not easy, and we applaud you all for taking on the challenge.

Other big gainers include retail tech and robotics. This is great to see… as long as everyone remembers that we were deep into robotics, with the likes of Somatic and Civ Robotics 4 - 5 years ago (i.e., way before it was cool).

Keep up the good work, friends!

New Investment

Our latest investment from our Capital Partners II fund, LeaseUp, is a commercial real estate (CRE) SaaS platform for brokers to automate much of the deal process. There are around a million CRE transactions annually in the US alone, yet the process hasn’t changed for more than 30 years. Each transaction for a broker involves generating lengthy reports (often 50 pages or more) for potential tenants, including data compiled from internal and multiple third-party sources, all of which is done manually and can take days to complete for each prospective tenant (this also happens to be the pain point that ultimately drove founder, Kurt Chisholm to quit his job as a CRE broker and start LeaseUp).

In addition to dramatically reducing the time spent on each pitch (both a material cost saving and a competitive advantage), LeaseUp’s product offers a host of other features to address most of the administrative deal-support functions for brokers and back office staff (e.g., automating site selection, tour scheduling, document sharing, etc.), provide real-time transparency for management teams on critical information (that they currently receive on a 30-day lag, at best), and provide new point-of-sale cross-sell/upsell opportunities for brokers to increase average revenues per transaction.

Given the obvious and easily quantifiable customer ROI (both on the cost and revenue side), we would view this as a very attractive product in a booming market, and we believe it will be viewed as almost a requirement in a challenging market like the industry is facing today (something that was reinforced in reference calls with CRE brokers, who commented on their leadership constantly banging the drum in recent years on innovation and operational efficiency).

C2V Watercooler

Chris recently shared a post about Bridge rounds and seed extensions for companies outside a VC’s portfolio. Traditionally, VCs like being first-money investors and supporting their existing companies through thick and thin.

But what if existing investors can’t fully cover a bridge round?

The question: Should new investors jump in at these higher-risk “in-between” stages?

View the post and share your thoughts.

Portfolio Highlights

Rigorous Introduces B.O.B. Flexible Robotic Solution to Support Vermont Manufacturers

Rigorous Technology, a Williston-Vermont robotics company, has announced the development of a new collaborative robot solution tailored toward first-time robotics operators. The Box Order Bot, or B.O.B. for short, is designed for ease of use and flexibility to empower small—to medium-sized Vermont manufacturers in their automation journey.

Olive’s Platform Goves Contractors Unbiased Advice on IT Decisions

Over the past four years, Flynn, an AGC of Idaho member, has used Olive’s online platform to procure a number of key software programs, including systems for human resources, learning, and development. By streamlining Software Procurement, Olive’s platform gives contractors unbiased advice on IT decision management and expense management. Alan Zych, Flynn's vice president of information technology, said Olive’s unbiased IT advice will guide several more software upgrades this year. “You need to purchase a lot of software to digitize your business successfully, and frankly, it can be difficult and time-consuming, so it makes a lot of sense to avail yourself of tools that make it easier,” Zych said.

Driver Technologies and RepairPal Team Up to Provide Consumers with Trusted, Certified Repair Facilities

"We're excited to partner with RepairPal to provide free auto repair advice through its Car Genius program to our users to continue our mission to democratize road safety worldwide," said Rashid Galadanci, CEO and co-founder of Driver Technologies. "By partnering with RepairPal, we can connect with drivers who are already actively engaged in safe driving practices and can provide them support to connect with auto repair experts for mechanical advice and education on vehicle repairs as well as recommend certified shops who provide high-quality work at a fair price."

Five levels of AI, venture's recovery & the hottest construction startups

Argyle was featured in this episode of This Week in Startups, from host Jason Calacanis, which talks about the best AI construction startups.

Maret Thatcher and her team are trying to solve this simple question: How can they make BIM and AR truly useful on the job site?

The answer is to focus on rock-solid alignment tech first. Their journey was longer, but it’s why trusted contractors rely on them for complex projects.