C2V October Notes From The Trenches

Welcome friends! Well, if you haven’t had enough of us shouting into the void about the reckless destruction of capital going on in the plus-sized end of the venture world these days, we decided to run it back one more time, only with more math. You’re welcome.

Seriously, though, this will be it for at least the next two months as we roll out our annual deal-flow awards in November and 2026 predictions in December, so bear with us while we wrap this up.

In researching last month’s newsletter, we came across a fairly shocking number of quotes from prominent, late-stage mega fund managers that are all some version of this (from a well known market participant)…

Valuation matters far, far less than the decision of whether to invest or not.

… and we couldn’t let it pass without some serious pushback.

Valuations Don’t Matter (?!)

Of course, we all strive to invest in the best companies with the biggest outcomes, but this way of thinking about that goal relative to when and at what price we invest in these companies is not just wrong, it’s the exact inverse of the way this actually works. In fact, when it comes to generating investment returns, if you get the valuation wrong, nothing else matters.

For example, let’s say you invested $20 million in each of two companies, Company A has an exit at a $100 million valuation, and Company B at $10 billion. The better company is obviously Company B (by a wide margin), but which was the better investment?

Well, if this most fundamental of questions is unanswerable without knowing your entry valuation (as it clearly is), how can entry valuation be irrelevant? Right, it can’t. In fact, even if you knew with absolute certainty that a specific company was going to be the largest exit of a given year, there’s still a valuation level at which passing on it will actually be accretive to your overall returns.

We’re not entirely sure where or when this idea that valuations are irrelevant became a regular talking point (or how it’s still being espoused by the same managers who are sitting on dozens of valuations for 2021’s “must own” companies that remain 50% or more underwater), but it almost seems like the average mega-fund manager believes there are two sets of potential venture outcomes, one for the Seed/A/B/C investors and a second one for them (which is several times larger).

That, or they actually believe they’ll be able to identify the absurdly large percentage of every 3 – 4 year cycle’s largest exits that it would take just to generate slightly above average returns. Along those lines, we encourage you all to check out Josh Kopelman’s new Venture Arrogance Score, which does a nice job of quantifying this fantasy (seriously, bravo, Josh; we couldn’t be more jealous that we didn’t come up with this first).

Obviously, the mega fund strategy is the extreme for all of this (which we’ll get to below), but valuations absolutely matter for all stages and strategies, and that also seems to be getting lost, even at the very early stage, as median Seed round valuations (and Seed funds themselves) grow ever larger. So, we’ll start with a quick breakdown of two fairly common versions of today’s Seed strategy that we’re seeing to try and illustrate just how much of a drag on returns (and increase in risk) you incur by being too loose with valuations.

Seed Fund Math

Two examples to illustrate this. For both funds, we’ll assume:

75% of committed capital is “investible” (the rest going to management fees and operational expenses)

60% percent is allocated to initial investments in 25 companies

The balance is allocated to follow-on rounds in the best 13 of these companies

Industry average dilution at each round (~20% at Seed and Series A, 10 – 17% for subsequent rounds)

A minimum of one-fifth of each round is set aside for existing and other new investors (so neither fund can take more than 80% of any round).

We’ll use a simplified version of Fred Wilson’s “1/3 Rule” (which essentially puts numbers to the VC power law), where 1/3 of the companies drive most of the fund’s returns (in this case, we’ll assume the other 2/3s return half the fund).

The last funding round before exit for each of the return-driving third is Series D

Fund 1

$225 million in total commitments

$4 million per company at Seed

$5.4 million of follow-on capital per company (deployed at Series A & B)

3.0x net return target (top quartile or better in nearly all vintages)

Average Seed round post-money valuation: $20 million (this is the minimum needed to make that initial check size work, and if you’re thinking this is a strange way to come up with a valuation, you’d be right… But this is exactly how we see it done in nearly every round led by these plus-sized Seed funds).

The results:

Average ownership at exit: 14.4%

Exit needed for any one company to return the entire fund by itself: $1.6 billion

Average exit needed from each of the 9 return- driving companies (we rounded up) to hit the target return: $520 million

Fund 2

$100 million in total commitments

$1.8 million per company at Seed

$2.4 million of follow-on capital per company (deployed at Series A & B)

3.0x net return target

Average Seed round post-money valuation: $12.5 million (roughly our average entry valuation in our first two funds; our funds are smaller, but the math at $100 million in commitments still works fine at this valuation level)

The results:

Average ownership at exit: 9.8%

Exit needed for any one company to return the entire fund by itself: $965 million

Average exit needed from each of the 9 return-driving companies to hit the target return: $322 million

Takeaways

While the ask of the larger seed fund in this example certainly isn’t crazy (not mega-fund-crazy, anyway), the difference between the two is substantial, with the more price-concsious fund having both materially lower risk of underperforming and materially higher upside. For example:

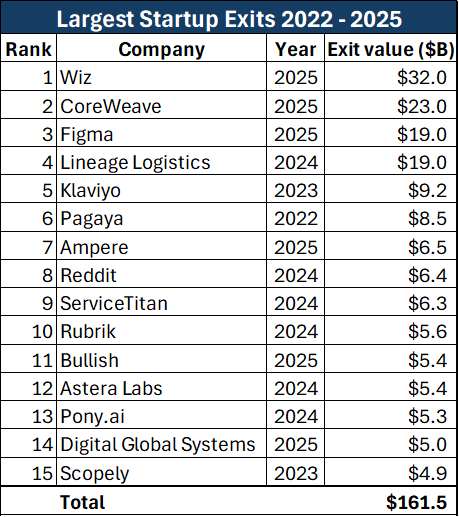

In the past four years, there were nearly twice as many exits of at least the size needed for the value-conscious manager to return their entire fund (actually 1.5x, including the 16 also-ran companies) with a single exit.

The average exit among the 9 return-driving companies needed by the more value-agnostic manager to be a top performer is 2.1x the median exit value in 2025 (per Pitchbook), whereas the average required by the more value-conscious manager is only 32% above that median.

If both managers were to hit on a top 100 exit within a fund cycle like the past four years (~$5 billion at the low end), that exit alone would result in a net return to investors of 4.3x their investment for the value-conscious manager and 2.8x for the price-agnostic manager. While we’d imagine investors in either fund would be pretty happy with such an outcome, it’s still a material delta — roughly the difference between doubling the S&P’s annual return and tripling it over the same 10-year period.

Really, the only rationale for raising funds that are too big, forcing you to overpay (other than the cynical but definitely still true reason that management fees on $225 million are 2.25x larger than those on $100 million), would be if there were some correlation between early-round valuations and outcomes. But both a handful of industry studies and our own experience show that there is no correlation whatsoever.

So, if even a relatively small difference in valuations has an outsized impact on return variance and upside potential, what does it look like at the extremes? Well, there’s leaving some risk mitigation and upside potential on the table, and then there’s “how did this strategy ever make it off the white board”?

Late-Stage Mega-Fund Math

General Assumptions:

75% of committed capital is investible (same as with the Seed funds)

40% percent allocated to initial investments (lower than the Seed funds due to the acceleration of round size growth as you go further into the alphabet)

15 total companies (these funds are more concentrated due to 1) the limited pool of opportunities at these stages, 2) the size of each funding round, and 3) because companies at this stage are, ostensibly, much surer bets)

Follow-on capital allocated to all 15 companies (as, again, these are “sure things”, and since it’s just the company that matters, not the price, you couldn’t possibly throw enough money at them, right?)

We use industry medians, per Pitchbook, for valuation and funding at each round

A minimum of one-fifth of each round is set aside for existing and other new investors (same as with the earlier rounds).

While managers of these funds liberally throw around the power law in discussing their strategies, since the power law doesn’t really apply when the single largest exit ever wouldn’t even get you to an average return, we’ll let them slide on the fact that the power law would also mean a substantial portion of each portfolio should return 0-1x, and assume all 15 companies will positively contribute to returns.

Investments start at Series D, and the last round for every company prior to exit is Series G

Fund Math

$2.5 billion in total commitments

$53 million per company at Series D

$80 million of follow-on capital per company (deployed at Series E - G)

3.0x net return target

Results:

Average ownership at exit: 8.5%

Dollar-weighted average entry point: $2.1 billion

Exit needed for any one company to return the entire fund by itself: $29.3 billion

Average exit needed from each of the 15 portfolio companies to hit the target return: $6.9 billion

Total exit value needed: $102.7 billion

To put these numbers in perspective, over the past 4 years (the wide end of the general exit window for funds at this stage), there have only been 35 exits at least as large as this fund’s average entry point, and only 8 at least as large as its target average, and that’s across all categories. Assuming most (if not all) of these funds have at least some sector/product focus, that pool shrinks even further.

We’re also being extremely generous in our valuation and raise assumptions by using median numbers. If we use averages instead (likely a lot closer to many of these funds’ actual numbers), there are only 8 exits larger than the average price paid for each company ($8.3 billion).

But that’s not even the craziest part.

Using the more generous median funding round numbers, in order to hit the 3.0x net return target, the fund would have to be in at least one of the three largest exits of the past four years, plus (at a minimum) each of the 5th through 18th largest exits, and even if it managed a clean sweep of the top 15, its largest possible net return would still only be 4.6x.

Still not the craziest part.

Using the average funding round numbers, a 3x net return is not even possible. Even if this fund achieved the stated goal of just making sure they were in every one of the 15 largest exits, their net return would be 2.0x.

Now, one might argue that these results assume uniform capital allocations and valuations across all companies, and any manager clairvoyant enough to predict every one of the top exits over a 4-year period could surely dollar-weight them correctly as well. Of course, anything’s possible (though if you knew which company would have the biggest exit in a given period, why wouldn’t you just put the whole fund in that one name?), but what if the opposite happens? What if you do manage to get into one of these top 3 exits, but you bought into it at a much (much) higher than average valuation…

Figma IPO

As much as (we hope) the outline we modelled above makes our point, it still assumes a level of price discipline (in sticking with uniform, industry average price points) that is almost certainly still too generous, so just to really hammer how badly this strategy of being in the best names at any price actually plays out when put into practice, let’s look at the real world example of Figma.

As we mentioned in our September newsletter, 8 of the 10 $1 billion-plus IPOs thus far in 2025 debuted at a price lower than at least one (and as many as three) of the companies’ private funding rounds, producing losses for VCs who invested in these rounds. One of the two that produced positive returns for everyone was Figma, the third-largest exit of the past four years, and pretty much the literal embodiment of the company you have to be in, regardless of price, if you subscribe to this idea.

Well, let’s see what happens if we run the exact same model we outlined above for a late-stage investor in Figma. If we make it a $1.5 billion fund, the math actually works out more or less perfectly for a firm that first invested as the Series D lead and then followed on in the next and last (Series E) round (there might even be a firm that did exactly that…).

In the best-case version of this not-necessarily-hypothetical example, the fund would receive $400.3 million in proceeds from the IPO. But that’s really where the good news ends. In the best-case scenario, that fund might have been able to take $40 million of Figma’s $50 million Series D round and, based on the earlier allocation assumptions, add another $60 million in the Series E.

The result? A 3.8x gross multiple on this investment and a net return to LPs of 22% of total commitments (and while they could have theoretically invested more at Series E, that would actually make the return multiple worse, as the Series E ROI was only 1.5x).

We’ll spare you the math as far as what this means for overall portfolio returns, but suffice it to say that if the third-largest IPO in a 4-year exit window only returns a fifth of your fund, it’s pretty much game over. Forget 3x returns, your LPs will be lucky to even get all of their original investment back.

Honestly, how does a manager (or even an entire strategy) realistically come back from something like that?

Apparently, by quintupling down on the strategy with a $20 billion fund.

We give up.

On to our newest investment (made at a valuation where, if they end up being the next Figma, we and all of our investors will be retiring about 30 seconds after the bell rings on the NYSE)…

One day, we’re going to run out of companies that are even dirtier, duller, and more dangerous than the ones already in our portfolios. But today is not that day, as we welcome Pavewise, a SaaS operations management and automation platform for paving contractors.

Spawned from the pain points and inefficiencies founder Bryce Wuori experienced firsthand in his years managing paving projects, Pavewise’s platform compiles data from disparate sources, generating operational insights and automating regulatory and project sponsor reporting.

As with all of our DDD software companies, Pavewise creates material ROI through direct reductions in day-to-day administrative bottlenecks and actionable operational efficiency insights. But the company also collects project specification measurement and testing data, as well as real-time, hyperlocal weather data, and automatically generates contractors’ mandatory regulatory and project sponsor reporting, saving contractors millions of dollars a year in costs related to reporting delays, reworks, weather-related downtime, and other common compliance issues.

We’re excited to help Pavewise continue to take market share in the paving sector, as well as adjacent infrastructure construction and maintenance verticals in the future.

On The Road Again

Three events. Three regions. One clear theme is that innovation isn’t coastal anymore.

Over the past few weeks, Chris hit the road from Milwaukee to Cape Cod to Greenwich, speaking and connecting at Venture North, The Chatham Conference, and the Greenwich Economic Forum.

Each event brought together founders, investors, and ecosystem builders redefining where and how innovation happens.

At Venture North, 300+ founders and investors packed the room, proving that the Midwest isn’t just catching up, it’s defining what’s next in clean energy, defense tech, and industrial innovation.

At The Chatham Conference, Chris joined a panel on the “Proximity Effect” to debate whether geography still matters in venture. His take: sometimes yes, sometimes no. Execution and market fit outweigh ZIP codes, and lazy pattern-matching misses great companies, especially in the places others overlook.

And at Greenwich, the conversations reinforced how interconnected these ecosystems have become. Capital and talent are flowing in new directions, and the smartest investors are following the signal, not the stereotype.

What’s clear and drives our investing every day: Great companies can come from anywhere. The investors who truly believe that are the ones shaping the next decade.

Cylerity Raises $4M Seed Round and Secures Up to $24M Debt Facility to Fix Healthcare’s Slow Pay Problem

Healthcare’s Slow-Pay Problem has Been Broken for a Long Time

Most providers wait months to get paid for care they’ve already delivered.

Ryan Wheeler and the team at Cylerity decided that was unacceptable—and built a platform that uses AI to turn reimbursable medical claims into financeable assets, giving providers access to capital in hours, not months.

C2 Ventures is proud to co-lead Cylerity’s $4M equity round and $24M in debt capacity alongside HealthX Ventures and Upstream VC to help accelerate their mission of modernizing healthcare finance.

The opportunity here is massive: bringing real-time data, automation, and liquidity to one of the most complex financial systems in the world.

Excited to back Ryan and the Cylerity team as they scale a smarter, faster, and fairer system for healthcare providers everywhere.

Civ Robotics Hits the Road This November

Civ Robotics is hitting the road this November, showcasing its latest autonomous layout tech at two major industry events.

First stop: Dirt World Summit (Nov 5–7 | Grapevine, TX | Booth #220) — where the team will demo CivDot+, delivering laser-accurate layouts within 3/100’ (8 mm) precision, and CivDot Mini, capable of marking up to 18 miles per day with sub-inch (25 mm) accuracy.

Then it’s on to Trimble Dimensions+ (Nov 10–12 | Las Vegas, NV | Booth #403), hosted by Civ’s investor, Trimble, to highlight how autonomous layout is transforming field operations and logistics.

Trusted by Bechtel, Boldt, and Primoris, Civ Robotics continues to help contractors accelerate infrastructure projects, reduce costs, and improve safety — proving robots really can play in the dirt.

They’re also hiring. If building the future of construction through robotics sounds like your kind of project, explore open roles across engineering, operations, and more: civrobotics.com/careers.

Armilla AI Expands AI Risk Intelligence Toolkit at ITC Vegas 2025

Armilla AI—the first MGA focused exclusively on AI insurance—launched its “Navigating AI Litigation and Risk” white paper and a new AI Litigation Database at ITC Vegas. The resource combines real-world litigation data with model-level testing, giving insurers and brokers both a rearview and forward-looking view of AI risk.

Analyzing 200+ AI-related cases, Armilla found that litigation around AI is becoming systemic, particularly in sectors like healthcare, finance, and employment. Beyond privacy and copyright, new exposures are emerging from model performance failures and hallucinations.

The database powers Armilla’s underwriting with live intelligence, helping quantify and price AI risk more accurately. Through its new Partner Portal, brokers can access searchable case data, emerging litigation trends, and educational tools to guide clients through the evolving landscape of AI liability.

SendTurtle at DC Startup & Tech Week

SendTurtle is kicked off DC Startup & Tech Week (formerly DC Startup Week), connecting with founders and early teams across the DMV. The team’s AI-powered platform helps startups sign, send, and summarize documents—turning eSign workflows into real-time insights. If you’re in town, catch them at events all week.

Retrievables Adds Mercury to Its Partner Network

Retrievables announced a new partnership with Mercury, expanding its Partner Network to include the modern banking platform used by startups and growth-stage businesses. Retrievables clients will now gain access to exclusive offers and financial services from Mercury, complementing Retrievables’ network of lenders, attorneys, and collection agencies.

The collaboration builds on more than a year of partnership through Mercury’s perks program and creates smarter ways for businesses to manage capital and recover unpaid invoice funds.

Noteworthy AI at Grid Forward Conference

Noteworthy AI joined leaders from Buzz Solutions, Overstory, and Pano AI at the Grid Forward Conference to discuss how artificial intelligence is transforming grid reliability and resilience. CEO Chris Ricciuti spoke on the panel “Unlocking Insights of Visual Information from AI,” highlighting Noteworthy’s work in turning visual data into actionable intelligence for utilities. The team also connected with industry peers, driving innovation across the energy sector.

The Moment When Frustration Meets Innovation

For Bryce Wuori, that moment came after a decade managing paving projects across the country—watching time, money, and quality get lost to weather delays, mismanagement, and missing data.

Instead of accepting it, he built a solution.

Pavewise turns the chaos of road construction into actionable insight—helping contractors make smarter decisions, stay compliant, and keep projects on schedule. Since launching in 2024, they’ve rolled out advanced weather tools, Density+ for quality tracking, and now work with 27 contractors nationwide.

C2 Ventures led Pavewise’s $2.5M seed round, fueling their expansion beyond asphalt into heavy civil construction—and helping make smarter, safer, more connected jobsites the new industry standard.

Proud to back Bryce and the team as they modernize one of the world’s oldest industries, one mile at a time.

Cylerity is Hiring: Early-Career Data Engineer (Madison, WI)

Cylerity—a fintech accelerating healthcare providers’ access to working capital by turning reimbursable claims into financeable assets—is hiring an early-career Data Engineer. You’ll build and maintain data pipelines, own data quality, and partner with engineering and ML teams to deliver trustworthy, usable data that powers the platform.

Core skills: Strong SQL; scripting in Python/TypeScript; data viz (Matplotlib, d3.js); clear communication and independent problem-solving.

Nice to have: Azure (Data Platform/Data Factory), ELK, FastAPI/Express, and familiarity with financial/healthcare data.

Details: Full-time • Madison, WI • Reports to Lead Engineer/CPO • Open until November 20, 2025.

Apply: cylerity.com/careers/data-engineer