C2V February Notes From The Trenches

Welcome friends! As you might expect, the atmosphere at C2V HQ has been charged this week in the lead up to the world’s most highly anticipated every-four-years event… the C2V Leap Day Newsletter. Some may shrink in the face of such expectations, but around here we eat pressure for… [breakfast? dinner?]… so rest assured, we’ve dialed up content equal to the occasion.

We thought about letting Matt run with another Super Bowl ad review, but decided to pivot as it was shaping up to be awfully similar to last year (not Matt’s fault — A) he likes what he likes and B) step it up, Madison Ave.).1 Nonetheless, we’re going with more serious content instead, so without further ado, some insights on our current macro perspective.

A Seemingly Robust Economy That Feels a Bit… Off

By most major indicators, the US economy is firing on all cylinders. The primary stock market indices all recently made new all-time highs, as did US home prices, while unemployment remains near all-time lows, with January marking the 26th straight month of an unemployment rate of 4% or below, the longest such streak since the 1960s. Add to this the fact that the specter of runaway inflation has largely been subdued and you have a rash of market analysts and pundits dusting off the old “goldilocks economy” label.

That having been said (and at the risk of coming off as somewhere between overly cynical and outright paranoid), we can’t shake the feeling that we’re not on as solid a footing as it may appear.

Our primary reasons for a note of caution are (in no particular order):

Interest rates: While not excessively high (historically speaking), rates are near their highest levels since the early 1990s (and dramatically higher than the preceding 15 years), and we have yet to see much of the impact on either new borrowing or equity pricing that typically comes with rates at these levels. During the prior few instances when the Fed Funds rate was above 5% for a sustained period, the price-to-earnings ratio on the S&P 500 either declined to/remained around one-third lower than it is today, or it stayed high too long, the market tanked, and we went into a recession. Not that history always repeats itself, but… well, it’s more consistent than not.

Debt Levels: All three major segments (household, corporate, and government) are at or very near 2-decade highs as a percentage of Real (inflation-adjusted) GDP. With much of this debt priced when Fed Funds were near zero, there is significant risk to future growth as existing loans mature and need to be paid down or rolled over at much higher rates. This isn’t 2008-levels of danger, but it’s not nothing either.

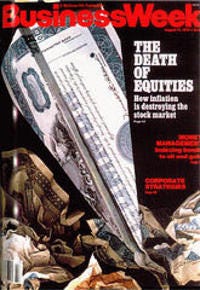

Goldilocks: The last time we can remember the financial commentariat throwing around “goldilocks economy” this liberally was 2006, and we all remember how those next few years went. And while you might may be thinking this seems less like analysis than witchcraft, sentiment matters. Quite a lot, in fact (see the writings of Keynes or Greenspan, coiners of “animal spirits” and ‘irrational exuberance”, respectively, for more color on that). Excessive amounts of optimism, pessimism, or complacency tend to lead to market reversals (i.e., the economic porridge doesn’t tend to remain ”too hot”, “too cold”, or “just right” for very long). Just ask Business Week, who famously published this cover story a few weeks before the start of the longest bull market in history.

We certainly appreciate that this is a rather cynical view and we could of course be fretting about nothing. Then again, as Joseph Heller famously said in Catch-22:

“Just because you're paranoid doesn't mean they aren't after you.”

More of the Same in Venture Capital

As has been the case for the better part of a year now, the early-stage markets (Seed-to-Series B) remain relatively healthy, with funding and valuations still off from the peak, but at or above pre-bubble levels, while Series C and later continues to deteriorate. That said, the gulf is still widening and that seems likely to continue, perhaps at an accelerating pace.

While early-stage markets are showing signs of returning to their long-term (gradually up-sloping) trajectory, we continue to see new and increasingly ominous data points coming out of the late-stage markets, and there are signs pointing to things getting significantly worse before they get better.

Down Rounds

Down rounds2, generally rare, have increased in frequency across all stages of funding, though the frequency and severity of these re-pricings are dramatically larger in the later stages, now accounting for (per Carta) more than a quarter of Series D & E funding rounds (vs. a roughly 10% historical average).

Secondary Markets

Even more ominous is the real-time data we’re seeing from secondary markets.3 Recent data we reviewed from one of the largest venture secondary platforms (with consistent activity across at least 75 - 100 late-stage companies in most weeks), shows a rather stark picture of current market valuations relative to nearly all of these companies’ prior venture funding rounds.

The overall picture is similar for closed transactions and posted offers (a good sign that this is a relatively efficient market), but we’ll show them separately for comparison anyway

Hats off to SpaceX and Liquid Death, the only two companies that traded at a premium to their prior funding round thus far in 2022

Of note, this is actually a bit worse than it looks. 2 of the 3 offers listed as premiums to their prior round — Klarna and Stripe — are only in that category because they recently raised (very, very) down rounds. Compared to peak funding valuations the current offers for these names are at discounts of 85% and 47%, respectively, leaving SeatGeek as the only company with shares on offer at a premium to its peak funding round valuation.

As stark as it is that nearly this whole segment is underwater, the magnitude to which this is true is what we really caught our attention. More than 84% of shareholders have sold, or are willing to sell, at a markdown of at least 25% and 55% are willing to take a haircut of 50% or more.

Time will tell if, when, and how quickly these numbers make their way into published portfolio valuations via funding rounds, exits or voluntary markdowns, but it stands to reason that the late-stage market is sitting on huge unrealized losses at the moment (and perhaps significantly larger than much of the market realizes/has priced in).

Where Does That Leave Us?

Perhaps not where you might expect. Notwithstanding all of our notes of caution, we remain optimistic on our corner of the venture space, in particular because of the resilience of the Seed and early-growth markets, as well as the continued (and voracious) appetite for software and robotics solutions in the large, legacy industries that our portfolio companies sell into.

We also remain optimistic that this will continue regardless of economic conditions because of the positive customer ROI these efficiency-focused products generate (products that allow you to do more with less being, arguably, even more valuable in a recession).

That said, we’re keeping a cautious eye on customer behavior and, in particular, portfolio company liquidity, doubling down on our focus on capital efficiency and encouraging founders to more aggressively stress-test projections and address any potential cash shortages sooner rather than later. While we haven’t seen the late-stage collapse trickle into Series A and B markets in any meaningful way thus far, we’d rather not be caught flat-footed if it eventually does.

New Investment

We’re pleased to introduce our newest pre-seed, Tributary Fund company, 3D Continuum, an AI-powered SaaS platform for heavy industrial companies to manage production efficiency and output data in order to optimize project management processes, as well as labor and equipment utilization, to increase production speeds and project margins.

Heavy industries such as mining, dredging, site remediation, and many others have all all seen significant upgrades in data collection technology in recent years (e.g., vehicle/equipment sensors, smart control towers, sampling and seismic equipment, etc.), but the software needed to collect, store and organize this data (never mind AI/ML applications for advanced analysis) has not kept pace. The result is a hodgepodge of data from different silos in different formats that must be manually compiled, formatted, aggregated, and organized, before it’s of any real use to decision makers.

This is not only administratively burdensome (even midsized firms often need teams of 5 or more people dedicated solely to data entry and administration, with as many as 20 or more at larger firms), but for ongoing projects whose tasking, location, and operating environment may be changing materially every few days, this operational data can lose much (or even most) of its value by the time it is useable.

The basic version of 3D’s platform allows customers to collect and organize data in real time via integrations with each of its various data collection silos, calculate standard and custom KPIs, produce reporting, and monitor project inputs and outputs against plans and projections (including options for setting tolerances that trigger alerts when exceeded, etc.).

3D is also building predictive models that customers will be able to use to proactively optimize project planning based on their own historical data, as well as industry benchmarking, and (crucially) to adapt plans in real time to account for changing conditions experienced in the field (a regular occurrence in most of these projects).

For businesses like these, where margins are razor thin, equipment and labor is expensive, and the lowest cost producers generally win, we expect the value proposition of 3D’s productivity enhancements to be clear and enticing.

C2V Watercooler

Chris is speaking at New Orleans Entrepreneur Week (NOEW) 2024! Join him for this week-long event of innovation, culture, big ideas, and more! And will be wearing an even tighter shirt (kidding — we just wanted to see if you were still reading).

Register for free today: www.noew.org/register

Portfolio Highlights

The Noteworthy AI Team Announces its Next-Gen Camera System

Noteworthy AI is heading to the DISTRIBUTECH International conference next week. They are not just bringing the Noteworthy AI humans to the show - drop by to view the next generation of the fully autonomous vehicle-mounted camera system!

This cutting-edge technology significantly improves the system's ability to capture pole imagery by adding more high-resolution cameras, plus enhances depth-related use cases such as geolocation and clearance measurements due to stereovision improvements.

Field Operations Software Maximizes ROI for a Fortune 500 Forestry.

In the fast-paced and highly competitive world of forestry, efficiency is key. Fieldwork involving data collection, reporting, and communication can be time-consuming and prone to errors. This is where field operations software like Eskuad comes into play. By leveraging this advanced technology, Fortune 500 forestry companies can streamline their fieldwork processes, saving time and money.

Phalanx to Focus on Marketing and Strategic Partnerships with Grant

Receiving grant funding from the Arlington Innovation Fund is a significant milestone for Phalanx, and we’re excited to be supported by such a great growing innovation hub. The funds will help us to accelerate our growth and further our support to IT & Cybersecurity service providers, which will ultimately help small businesses operate with less fear surrounding cybersecurity attacks.

Lighthouse Labs will welcome 8 teams for Spring 2024, including Phalanx.io

Lighthouse Labs is pleased to announce the eight startups selected to participate in its Spring 2024 Accelerator program. Since 2012, Lighthouse Labs has put founders’ needs at the center of its program and engaged the entire community in the process of innovation and disruption. If you’d like to get involved, sign up as a mentor, attend our Meet the Cohort Social on March 6 or Demo Day on May 14.

Rigorous Announces New Website

Rigorous has made its digital mark with a new website set to educate and inspire visitors about using robotics.

Goodroads Announced New and Improved Website

Goodroads’ website got an upgrade, showcasing more about the company, case studies, and options to schedule a demo.

Take a look at the new website and share your feedback!

Point Made: Write Like Top Advocates

Transform your legal writing with the expert behind the best-selling legal writing book Point Made. In this class, Ross Guberman shares powerful techniques and practical guidance to enhance clarity, persuasiveness, and impact in your legal documents.

Let’s Talk Trash

Meredith Danberg-Ficarelli is the Co-Founder and CEO of WATS (Waste Administration and Tracking Software). She joins Matt Giffune to talk about how commercial buildings can improve how they handle all the waste produced daily. Meredith shares how she built WATS to help owners and tenants track all the waste generated through their commercial spaces.

Job Opportunities

Otis:

Otis is a pet health tech company backed by top venture investors tackling the accessibility and affordability crisis in pet care.

Beam:

Our mission is to empower people to improve their physical and mental wellness, bringing them to the next stage of their journey.

Copywriter - email people@beamtlc.com

Uptime Health:

At UptimeHealth, we aim to simplify and predict medical equipment service, purchase, and compliance events for outpatient healthcare providers.

Sr. Project Manager (business project management like integrating UptimeHealth and Dental Whale)

CFO (SaaS and Marketplace experience)

Want even more C2V? We thought so. Please follow us on:

Matt’s Super Bowl ad Top 5 (for those of you who were going to lose sleep not knowing) in no particular order:

E*Trade — Trash-talking babies plus pickleball? In.

Affleck/Dunkin Donuts — Masstastic as ever and the A+ Matt Damon cameo really took it to a new level.

This year’s edition of the beaten-to-death-joke-that-somehow-keeps-getting-funnier: Michael Cera/CeraVe.

The Deadpool Trailer — Okay, this is cheating, but like we said, it was a rough year. Plus I laughed out loud at least twice.

Christopher Walken/BMW — No exaggeration, this might be a top-5 of the decade, never mind 2024. Just an absolute masterpiece, starring an absolute masterpiece. Stand up and take bow, BMW.

Down Rounds are exactly what they sound like – when a startup raises at a valuation below that of its prior round.

While data from secondary platforms doesn’t provide as broad a sample size of companies as the funding round data provided by Carta, Pitchbook-NVCA, and others, it is generally more current and less subject to certain structural biases (particularly the selection bias caused by the reliance on reporting and price transparency from funding round participants).