C2V July Notes From The Trenches

Welcome friends! Thought we’d kick off the summer slowdown that never seems to slow down with a look at VC/startup land in the first half of 2025.

Exit Markets – the Reality & the Surreality

While we've previously discussed the divergence between the exit market narrative and the data (most recently January of this year), the underlying trends are accelerating, and the data continues to diverge sharply from the prevailing narrative.

Increasing Volumes

Source: Pitchbook NVCA Venture Monitor

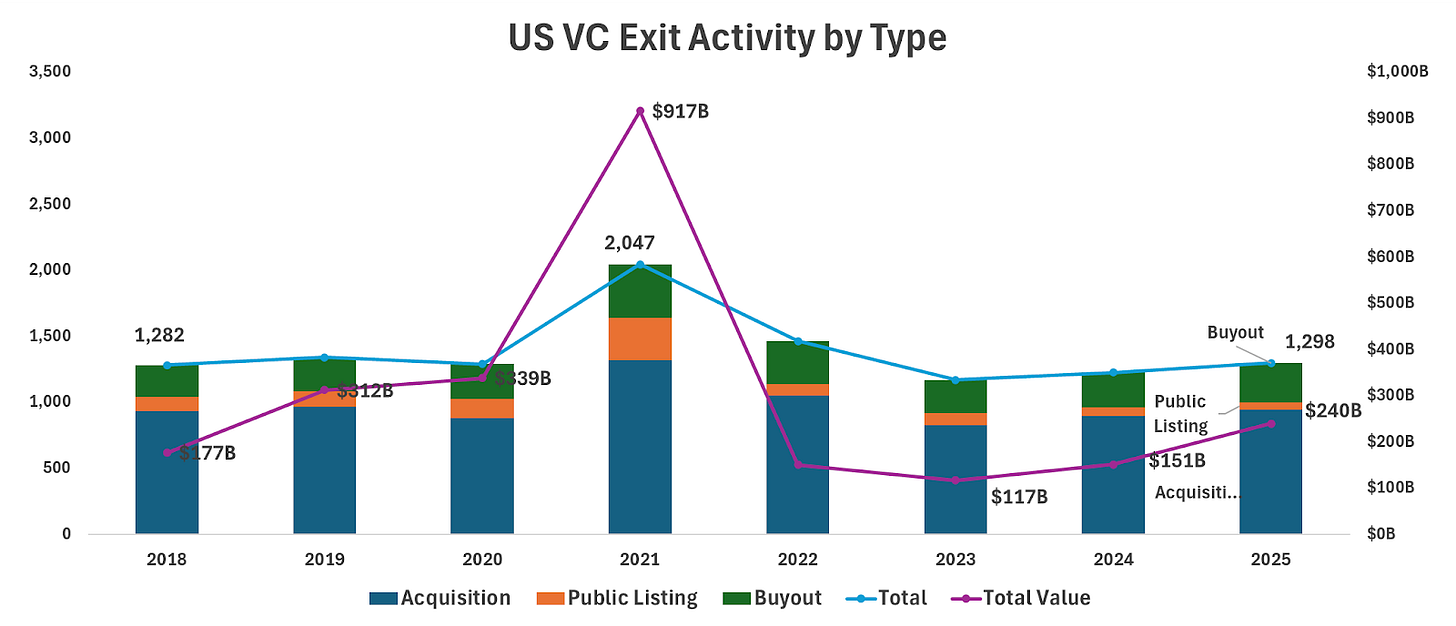

Both exit counts and dollar volumes continue to increase. In particular, the dollar volume of exits is on pace to grow 59% from last year, which would be the 4th highest of the past 12 years, and this with tariff uncertainty having frozen markets for a couple of months. Even more noteworthy, this increase is driven by strength in all three market segments.

Typically, big year-over-year increases like this are driven by public listings, and while public listings are on pace to double year-over-year, M&A and PE buyouts are also tracking toward 39% and 46% YoY increases, respectively. In fact, aggregate M&A and buyout dollar volumes (excluding public listings) are on track for their largest year on record.

Furthermore, we believe there is plenty of evidence to suggest that there is a tremendous amount of demand and a shortage of supply that would indicate we’re still in the early innings of this exit rebound.

Spiking Valuations

Source: Pitchbook NVCA Venture Monitor

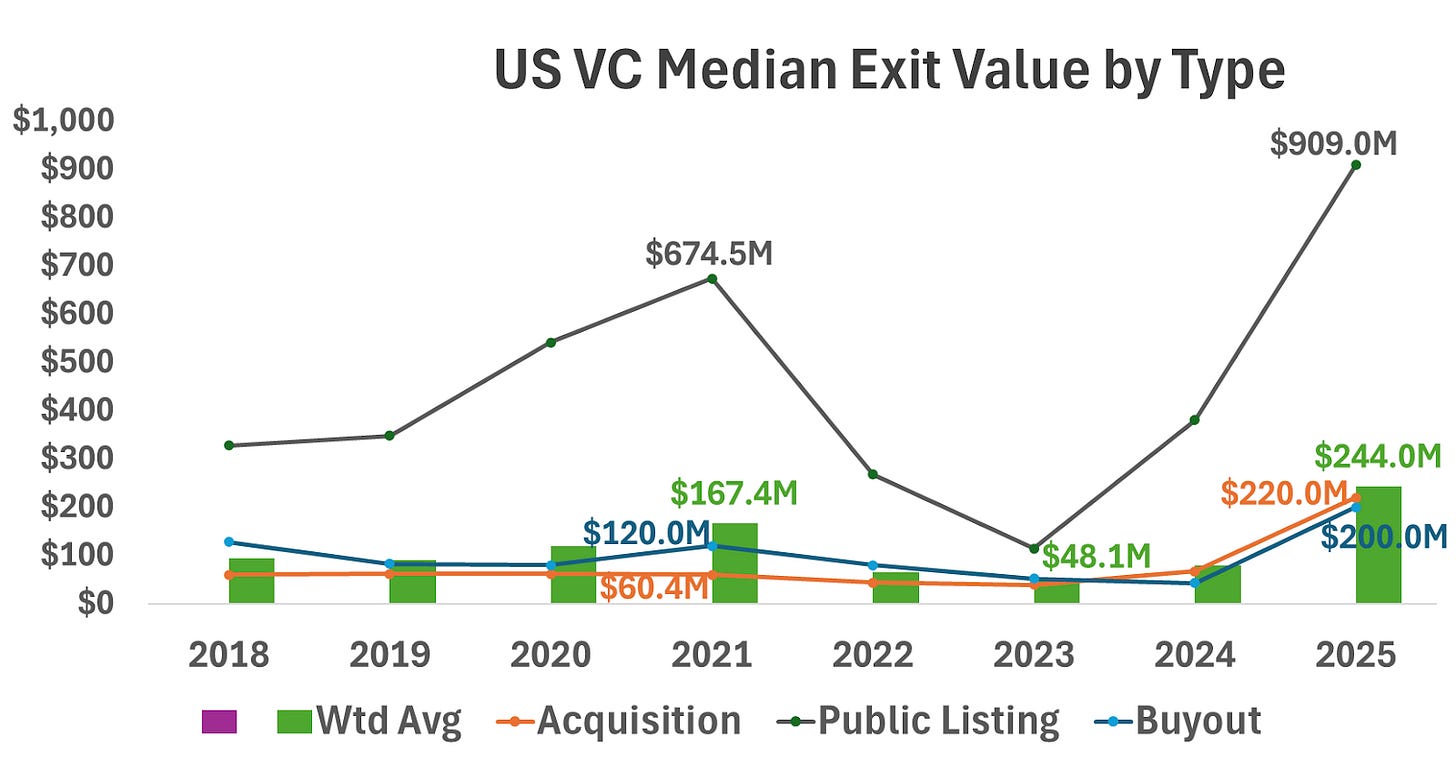

When it comes to exit values, it’s hard to overstate just how extraordinary this market is. Weighted average median exit values are up 3.1x over last year, and this is overwhelmingly driven by M&A and PE buyouts, which are up 3.2x and 4.7x YoY, respectively.

As further evidence of this strength in private market acquisition demand, according to Crunchbase, there have been 18 startup exits of $1 billion or more in the first half of 2025, and only 4 of these were IPOs.

Price increases of this magnitude in any market are a clear indication of a sizeable supply and demand imbalance. It is this obvious demand for mature tech company acquisitions that really flies in the face of the “sluggish exit market” narrative, pointing instead (along with plenty of supporting data) to a plethora of underwater sellers, unwilling to take their medicine.

New IPO Market Evidence

Ironically, it is the recent run of multi-billion-dollar VC-backed IPOs that has provided further evidence of the valuation issues holding back late-stage supply. As Pitchbook noted in its most recent Venture Monitor:

“Down-round IPOs have already become the norm, as nearly every high-ticket public listing YTD has priced well below their peak private round valuations.”

To say that losing money (or even breaking even) on a multi-billion-dollar IPO is a bad look for a VC, is about as big as understatements come.

Same Secondary Market Evidence

Recent transaction and bid/ask data from the secondary markets (the closest to real-time price transparency we have for what is otherwise an extremely opaque market) continues to show late-stage startups with 2020 – 2022 valuation marks that remain massively underwater.

The most recent weekly price data from Hiive Markets (one of the larger and more liquid platforms), includes 130 actively traded companies; of which there are 55 for whom Hiive was able to provide comparisons to prior funding round valuations.

Of these:

The median trading price is -44%.

Only 2 companies are trading above their previous rounds, with one at +3% and the other at +4%.

There are more companies (5) trading at a discount of 75% or more to their last venture round than those trading at a premium.

While discounts have slightly improved from -50% late last year, over 96% of companies are still priced below their last private valuation. In short, late-stage VC portfolios remain a mess, and (due to the extreme concentration of LP capital in these mega-funds) continue to clog up the venture liquidity cycle.

But surely, they've learned their lesson and are now taking a more disciplined approach, right…?

Startup Funding

… or they’re actually doubling down. Sigh.

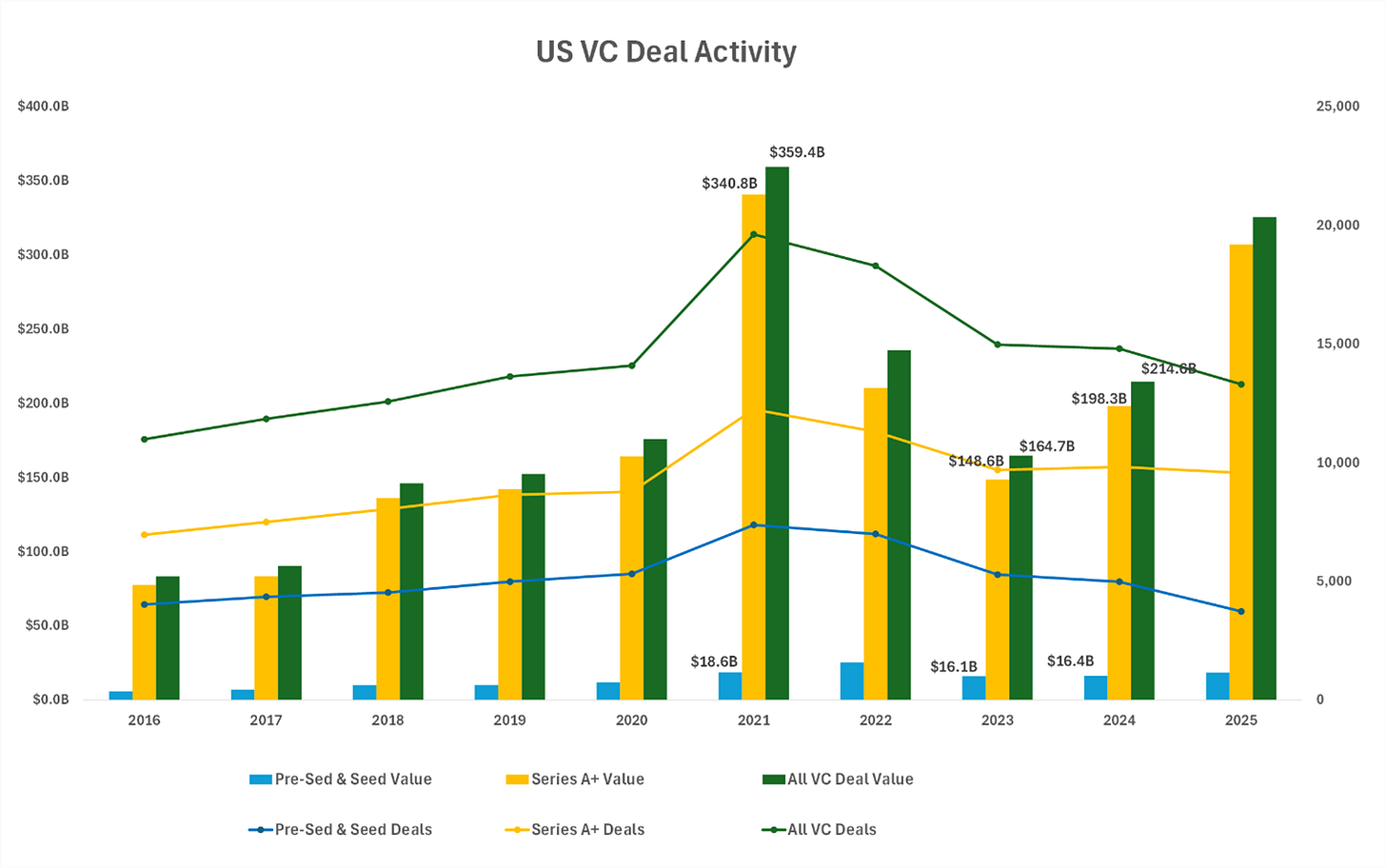

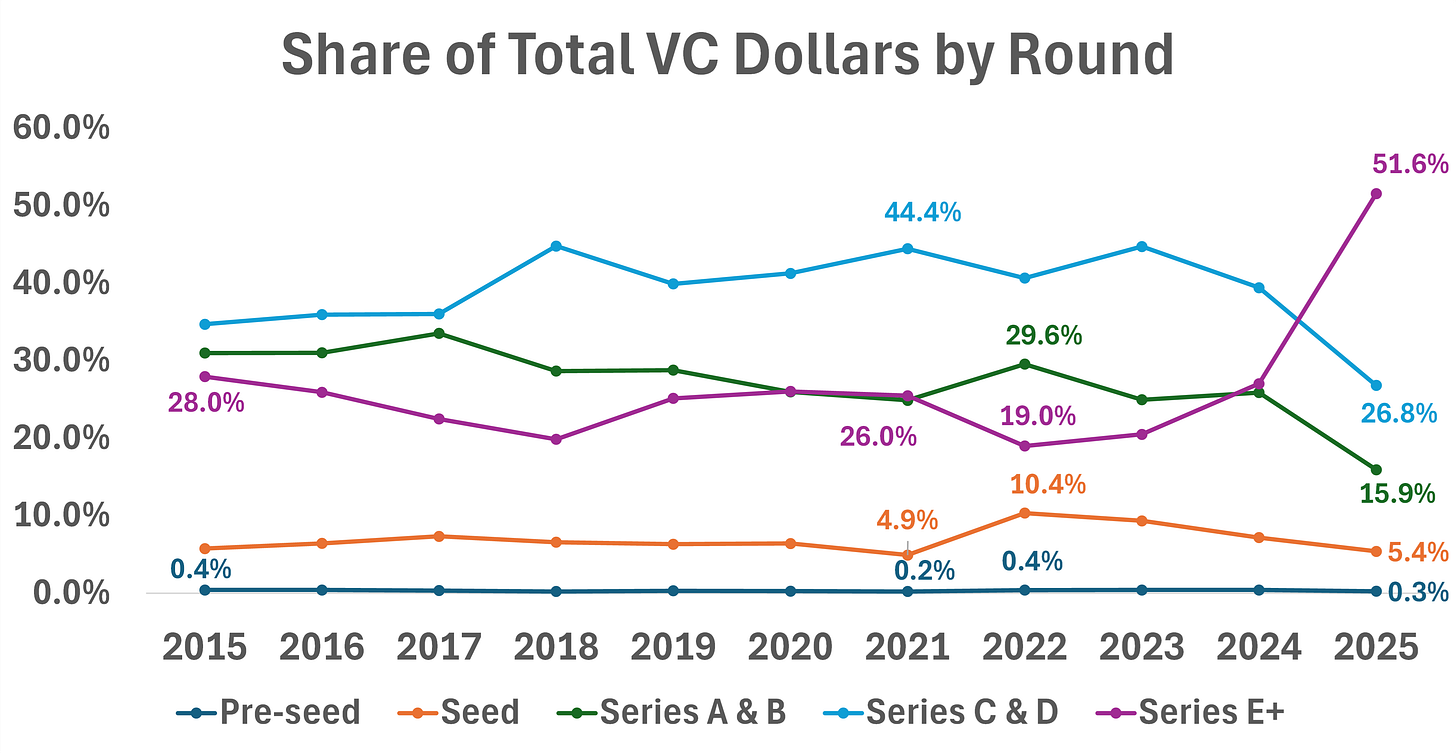

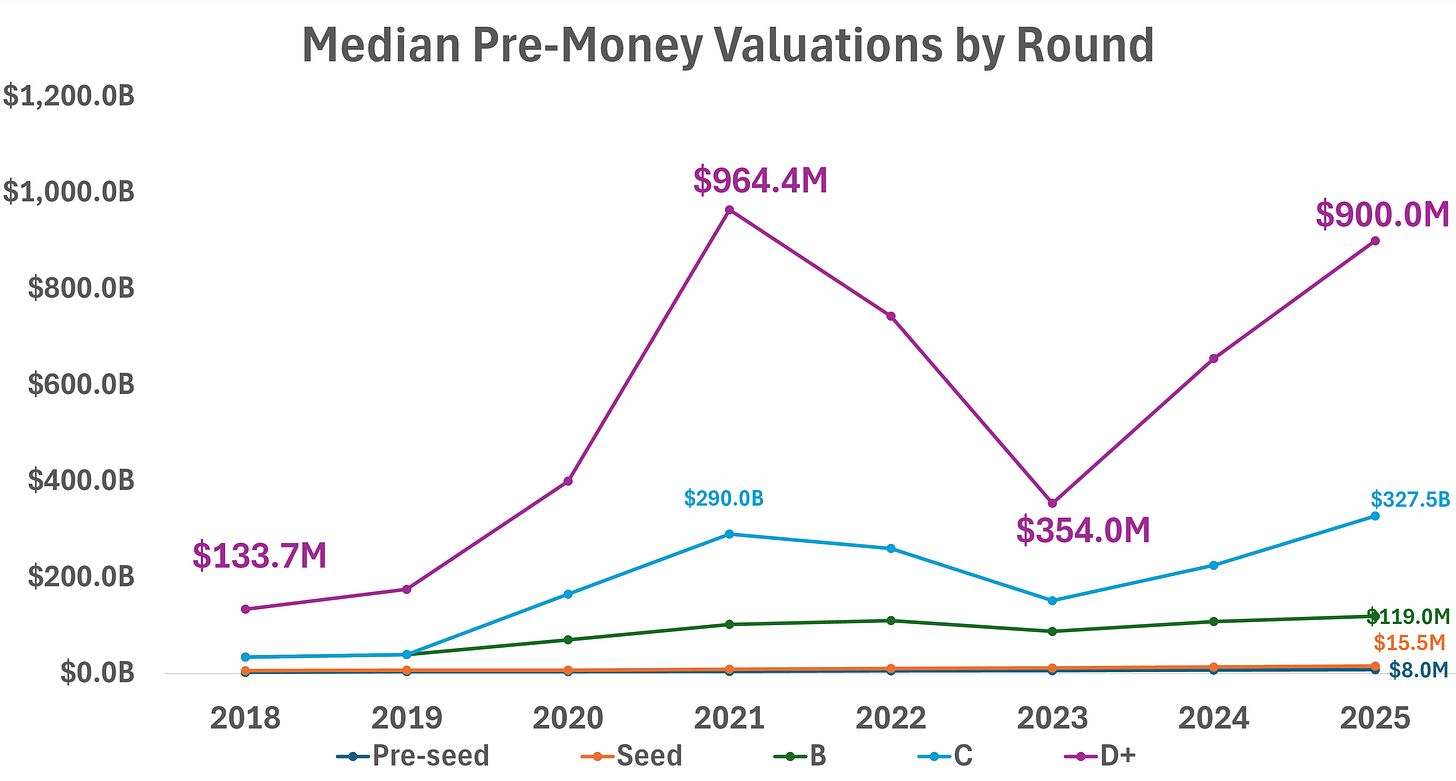

As in the prior couple of quarters, the headline numbers would suggest a huge bounce back from post-bubble lows and to be sure, there has been a nice uptick in funding across the board, but the extremity of this move is driven by Series D+ funding levels on pace to exceed even the historically frothy levels of 2021, while the share of startup capital in Series E+ rounds shattered its prior all-time high.

What’s different (and, from where we’re sitting, infinitely more dangerous) this time around is the concentration of this capital. Whereas, the last go-around’s spending spree was at least relatively well distributed, this time we’re seeing extreme concentration in a handful of mostly BigAI names. In fact, nearly half of all venture money deployed in the first half of this year went to fewer than 10 companies. The average Series E+ round in the first half of this year was double its 2021 peak.

Late-stage valuations have also spiked, hitting a median level just under 2021’s (at the time) extreme outlier level.

Suffice it to say, if the 2020/2021 version of this was a house of cards, this looks more like… I don’t know, a skyscraper of cards (in Miami, during hurricane season)?

We’ll wrap this up with a note of skepticism about where this unprecedented concentration of capital is going.

AI Foundation Model Companies

On the one hand…

We have companies like OpenAI. OpenAI has the most seasoned foundational model and is (as far as we can tell, anyway) the commercial leader by a healthy margin, not just with individuals, but (much more importantly) with enterprise customers. Among our portfolio companies that have built and deployed one or more domain-specific models layered on top of an LLM (which is most of them at this point), more use OpenAI as their primary LLM than any of the others.

On the other hand…

Pricing to Perfection (and then some)

OpenAI isn’t the only high-priced AI company, but it’s the largest, with a $300 billion valuation from its latest funding round, the largest VC valuation ever handed out. OpenAI is reportedly running at a $10 billion ARR run rate, just three years after launching its flagship product, projecting a $125 billion ARR by 2029 (for whatever that’s worth).

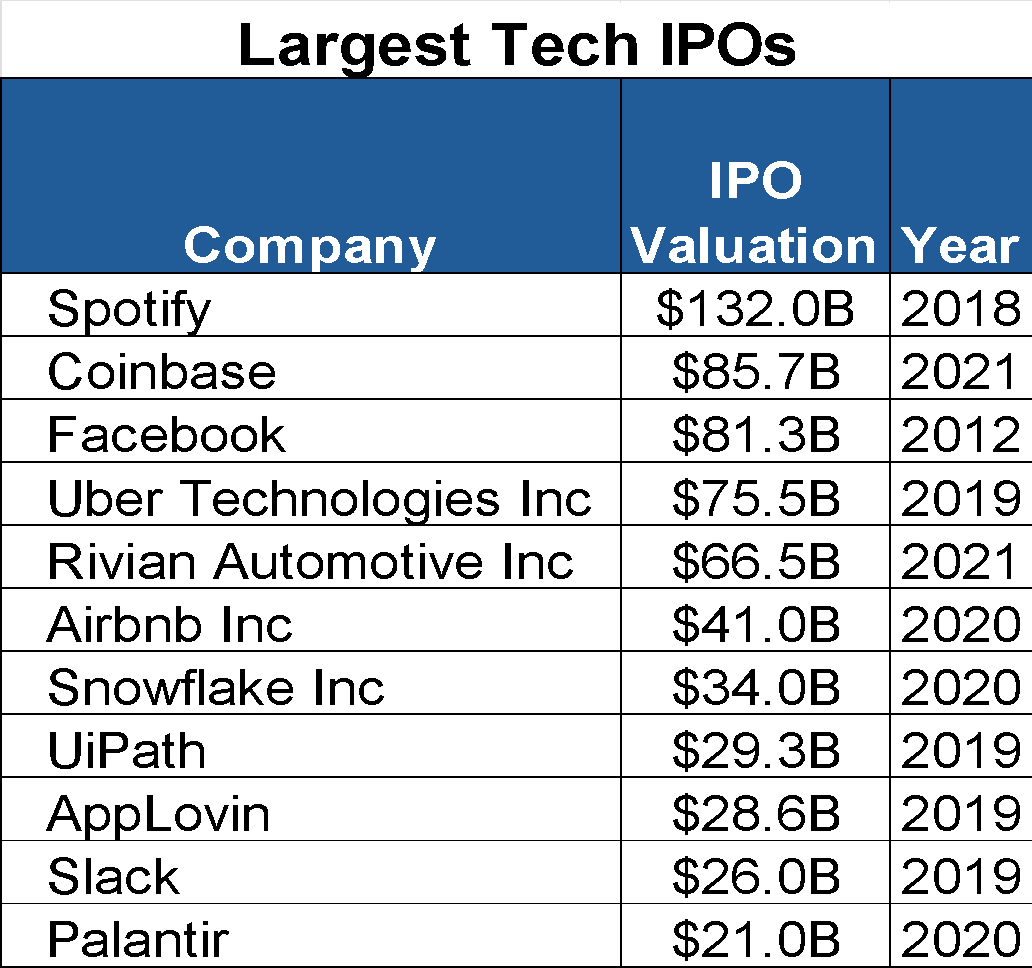

So, perhaps it will go public at a $1 trillion+ valuation in a few years, but such an IPO would be a historical outlier of extraordinary proportions. Only 12 companies globally are currently valued at over $1 trillion, and none have gone public near that mark, outside of state-run oil companies. Of the 10, there is the only one non-tech company on the list (honestly, Warren Buffet might still be underrated), so they (and we!) are certainly in the right space for this, but to hit the trillion-dolllar mark at IPO would shatter existing records.

Granted, before Spotify, there had never been a $100B+ tech IPO, and while Spotify’s $132B mark will eventually be eclipsed, will it be by 10x or more within the 5- to 7-year late-stage time horizon? Furthermore, at least half a dozen BigAI companies have raised valuations that imply similar outcomes.

Will public markets buy into one of these, let alone six? It's possible. We’d be impressed if OpenAI went public at $1 trillion, but not necessarily shocked. However, there are real risks the market seems to be ignoring in its FOMO-fueled buying binge.

For example:

We still have no idea what a mature LLM company’s economics will look like, and right now, they don’t look great. These aren't software companies with software margins.

Last year, OpenAI generated $5.5B in revenue but burned through $5B in cash.

Even craziers, xAI is reportedly burning $1B a month. In the time it takes you to read this newsletter, they will have burned another $400,000. It’s honestly hard to fathom.

LLM tech is still new, and with these burn rates, it’s unlikely to be sustainable. We’ve previously compared this to the early days of search, where initial leaders were eventually displaced by completely novel and vastly superior models. This could very well happen here as well.

Picking the Winners

OpenAI is one thing, but there are a bunch of other BigAIs raising (and rapidly burning through) similarly extraordinary sums of money at similarly optimistic valuations. Even if their basic models are trending toward uniformity, it would be naïve to think one or more of them won’t end up with material market share and at least some meaningful differentiation, but at this point you’re pretty much guessing as to who will get there.

Before anyone jumps in with the “venture investing is all about betting on founders and taking a leap based on early signs of big potential, etc.”, yes, this is true for folks like us who are buying into pre-seed and seed companies at 7- and low-8 figure valuations, where a single exit at one-tenth of Anthropic’s current valuation will return 10x an entire fund and you can easily afford to get several bets wrong.

But when a company is priced to absolute perfection, investors’ prognostications also need to be equally perfect, and that isn’t remotely the case here; there’s simply not enough information to go on at this point.

The “Why”

Not only are super-high-confidence projections simply not possible at this point, it seems (in many cases), like folks are just throwing darts; unconcerned with the lack of defensible answers to basic questions like “why this company?”

Take for example, xAI. Even assuming they fix the model and Grok 2.0 isn’t the racist hate machine that was Grok 1.0, why is an LLM trained exclusively on TweXitter content even a selling point? In what way will this be better than a ChatGPT or Gemini or any other model trained on the entirely of public domain content?

The monster that emerged from using X content as a training ground should have been surprising to exactly no one who’s spent any time on the platform, but let’s say you remove the enormous portion of X content that is people saying absolutely horrible things to each other, what are you left with? Content promotion, ridiculous conspiracy theories, fake science, a smattering of SF tech bros telling each other how awesome they are … did we miss anything? (Serious question — that’s really it, right?)

Again, why? Why would a single enterprise customer pay money for this, vs literally any of the other LLMs? Why would a consumer even sign up for this (other than, we suppose, the conspiracy theory and fake science crowd, who can now ruin our society at 20x faster rate)?

To be sure, our skepticism could prove to be completely unwarranted, and Softbank might finally make money for its investors, but… well, put it this way, this is the very asymmetric return profile that has made venture such an attractive asset class over the years… only completely in reverse. Buckle up.

Civ Robotics Secures $7.5M to Accelerate Renewable Energy Construction

We’ve been backing Civ Robotics since day one, and they just hit a major milestone, raising $7.5M to scale their autonomous surveying platform. Civ’s robots are transforming how renewable infrastructure gets built, delivering faster, safer, and more precise results than traditional methods.

This round marks a new chapter for Civ: from scrappy prototype to category-defining platform.

Top Leader, Ian Garrett, Weighs in on Balancing Security and Business

Ian Garrett, Co-Founder & CEO of Phalanx, advocates for a risk-based, collaborative approach to cybersecurity, emphasizing its role as a business enabler rather than a hindrance. His strategy begins with understanding an organization's strategic goals – be it market speed, customer experience, or compliance – to ensure security supports these outcomes. He champions embedding "secure-by-design" principles early in development through automation, threat modeling, and secure coding, aiming for "right-sized" security rather than perfection.

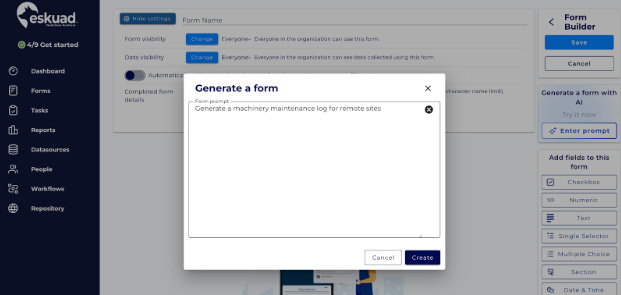

Introducing Eskuad AI: Generate Field Forms with a Text Prompt

Eskuad has launched a powerful AI-powered form generator that enables users to create fully structured digital field forms from a single text prompt. Users simply type a request, such as a safety checklist or equipment maintenance log, and the AI builds a customized form with fields, checkboxes, drop-down menus, and even logic. These forms are instantly ready to deploy to teams, working seamlessly offline thanks to Eskuad’s MagikSync™ technology. This feature dramatically speeds up form creation, empowering non-technical users to quickly design mission-specific data-collection tools and adapt on the fly to new regulations or project needs.

Civ Robotics Boosts Construction Speed with New Surveying Robot

Civ Robotics has developed a rugged autonomous surveying robot that speeds up construction layouts by up to 8× while improving precision on challenging terrain. The robot utilizes RTK GPS to accurately mark layout points, thereby reducing the need for manual labor and survey crews. Designed to operate in challenging outdoor conditions, it enhances efficiency for projects such as solar farms and infrastructure builds.

Armilla AI Helps Insurers Embrace AI with Confidence

As AI rapidly reshapes the underwriting landscape, the insurance industry is grappling with both opportunities and uncertainties. A recent Insurance Business UK article highlights the growing adoption of AI, from Aviva’s AI-driven “Actuarial Agent” to new algorithmic underwriting startups, while also revealing anxiety among brokers and actuaries about job displacement and their own readiness. Armilla AI is stepping in to fill the trust gap. Their partnership with Chaucer launched one of the first insurance products to cover AI model failures, helping underwriters adopt AI responsibly. In a space where risk meets innovation, Armilla is building the confidence insurers need to embrace next-gen technology without compromising reliability or compliance.

Rigorous to Host “Made Local: Automation Block Party” in Vermont

This August, Rigorous Technology will host the “Made Local: Automation Block Party” in Vermont, bringing together manufacturers, vendors, and partners like OnLogic and Massive Dimension. The event will feature talks from industry leaders on scaling automation, reducing bottlenecks, and maintaining quality in regulated environments. With sessions led by experts from Revision Military and VMEC, attendees will gain practical insights into adopting robotics on the factory floor. The gathering highlights Rigorous’s commitment to building stronger, tech-enabled local manufacturing ecosystems.

Driver Technologies COO & Co‑founder Marcus Newbury Honored as 2025 Insurance Rising Star

Driver Technologies is proud to announce that COO and co‑founder Marcus Newbury has been recognized as a 2025 Rising Star by Insurance Business America. The award celebrates his exceptional leadership and innovation in the insurance and transportation sectors. Newbury’s strategic initiatives have driven significant growth and enhanced service delivery across the company’s platform. This accolade highlights both his individual achievements and Driver Technologies’ ongoing commitment to excellence and transformation within the industry.