C2V March Notes From The Trenches

Welcome friends! We have a pretty packed edition this week, so we’re limiting this month’s intro to a quick roundup of recent venture news we’ve found interesting. As contractually required for anyone in this space in 2024, we’ll start with…

AI News

The Everything-is-Going-According-to-Plan Department

Broad market dynamics seem to be playing out as we predicted in our December newsletter, with the herd of “foundation-layer” applications thinning, as it becomes clear that this incredibly resource-intense segment will necessarily be the domain of only those with the biggest financial backing.

This is how we laid it out in December:

[T]he market for broad-based LLMs follows the path of early cloud computing with a handful of players best positioned to manage the (very, very) large-scale technological, customer support, and financial requirements emerging as an oligopoly of sorts (like today’s cloud market), while the rest fall by the wayside.

We mention this not because we think anyone is keeping score, but because we’ve incorporated this view in our approach to assessing AI applications, including the portfolio company we’re introducing below (how’s that for a table setter?).

The Big-Money Flex Department

Did Microsoft really make a $650 million acquihire? Sure seems like it (notwithstanding how it’s being described), but regardless of how you want to characterize the transaction, it’s a pretty compelling argument for the vast majority of Gen AI players to refrain from trying to fight the trend noted above and focus on the sector/use-case focused application layer of the generative AI-verse. After all, there aren’t many companies who can afford to drop half a billion-plus on their next few dozen engineering hires.

The Texas Hedge Department

At first glance, this concept of investing in startups that use the type of hardware you sell in order to create a captive audience seems to make sense… until you consider what happens if (really, when) some of these startups go sideways. Now, not only are you losing revenues, you’re also losing capital. And if, as the article suggests, you’re indiscriminately bidding up the valuations of these businesses (because your interest is commercial more than return based) you’re only increasing that possibility.

In short, aren’t you — like the legendary cattlemen of yore who “backwards hedged” (adding long cattle futures to their long cattle herds) — essentially just doubling up on risk?

SPACchanalia

Don’t worry, as your trusted oasis in the vast wasteland of increasingly toxic content, we’re not touching the event that prompted this reminiscence, but rather celebrating the stroll down this memory lane (one of our favorites).

We don’t have much to add to the article’s recap, other than to marvel again at how truly disastrous this SPAC craze was. Generally when a multi-billion-dollar public company abruptly goes bankrupt it’s huge news for weeks (years if you count the books written about it down the road), but apparently when this happens to multiple companies in a short period of time (plus dozens of others down so much from their first day of trading that they might as well be bankrupt), it seems we just hand wave it, give the sponsors giant podcast platforms to share their pearls of wealth destroying wisdom, and move on. What an era we’re living in.

In any event, we thank you, Joanna Glasner, that was a fun reminiscence. Is it too much to ask for a similar trip down NFT Lane in the coming weeks?

Sam Bankman Fried

Just a couple quick thoughts here.

First, how many times does this need to happen before anyone backed into a corner, who might have an inkling that they can lie, cheat, and steal their way out of that corner and then neatly unwind all their nefarious actions and move on like nothing happened, remembers that:

This “strategy” has no chance of working to begin with (there’s a reason you were in that corner in the first place)

You always get caught

25 years is an incredibly long period to be locked into anything, much less a prison cell

Second, while we appreciate the idea of putting a bunch of convicted founders together in one facility would generate a massive backlash (white-collar country club prisons and all that), wouldn’t having to spend a couple decades listening to each other’s nonsense be the ultimate punishment for the SBFs and Liz Holmes of the world? Maybe kick it up another notch by hiring Adam Neumann as the facility’s Consciousness Elevation Coordinator? If that won’t scare off future fraudsters, we’re not sure what will.

New Investment

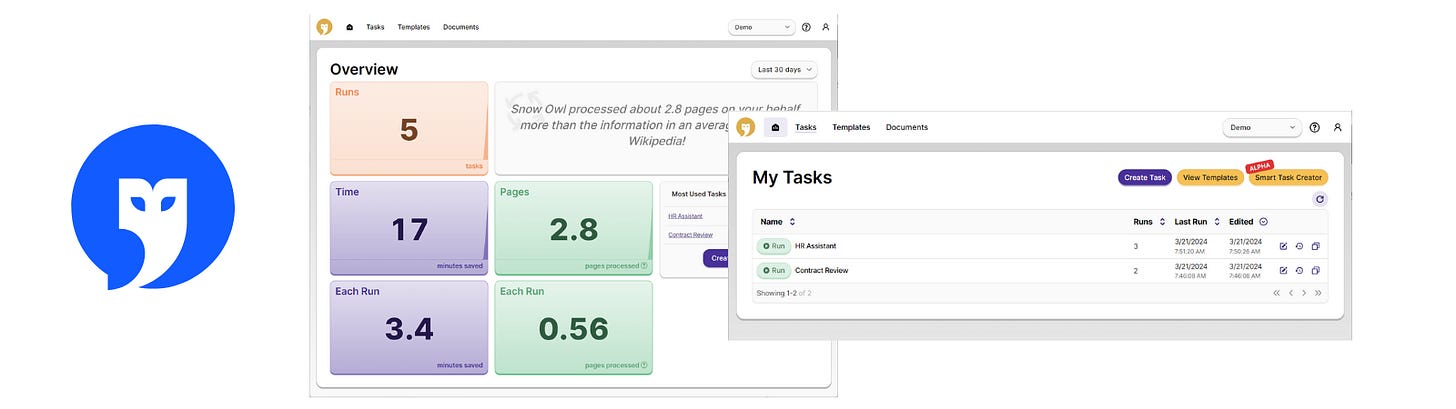

We are pleased to introduce Snow Owl, an AI workflow automation platform that provides an application specific layer to businesses looking to leverage the power of foundational Large Language Models (LLMs) like ChatGPT, in an intuitive, consistent and scalable way. Snow Owl’s initial focus is on creating a virtual coworker to take on heavily administrative tasks that burden employees in HR, Finance, and Marketing for a variety of sectors.

A huge amount of corporate administrative time is spent on tasks that involve things like manual data entry and summarization, reformatting or extracting information from large, text heavy source material.. These tasks are ideally suited LLM automation, but using LLMs directly is really only viable for simpler, one-off projects; it is not a scalable solution for more complex, multi-step, repetitive tasks without an additional layer of software in between.

This is where Snow Owl comes in, building applications that can consistently execute complex, multistep processes via simple and intuitive interfaces that require no particular technical aptitude from users. Snow Owl is getting great responses from its early customers while the product is just scratching the surface of its potential capabilities, and we’re excited to see where it goes from here.

C2V Watercooler

How Investors Should Prioritize Diverse Investments in AI

John Kell of Fortune featured Chris on how investors should prioritize diverse investments in AI.

Our portfolio has many strong female and minority founders leveraging AI to drive efficiency and profitability before AI became a thing.

We are proud to highlight our portfolio's highly diverse founder base and the win-win situation when founders solve fundamental problems in huge markets and use AI.

NOEW How AI is Changing The Software And Technology Investing Landscape

Artemis Scantalides and NOEW invited Chris to New Orleans to discuss how AI is changing the software and technology investing landscape. The event and the people were incredible.

Is pay-to-play the only way to keep the lights on?

Securing funding is crucial, but Chris questions the "pay-to-play" clauses that pressure early backers to invest more or get diluted constantly: LinkedIn video.

Find your champion!

Having an internal ambassador can be crucial to your success when selling to a company. Here is how to make this work: LinkedIn video.

Companies that have thought leadership are scaling

I’ve been digging into our C2V portfolio, examining companies that have embraced thought leadership and its impact on their scaling journey. They’re shaping conversations, attracting top talent, and generating leads faster. It’s not just about throwing content at the wall. Here’s what makes the difference: LinkedIn Video.

Portfolio Highlights

Somatic on their bathroom robot upgrades.

Amid concerns that robots could replace human janitors, Somatic CEO Michael Levy states that less frequent tasks, like stocking consumables, would still require input from local staff.

Driver Technologies Launches Commercial Fleet Referral Program

Driver Technologies, Inc. (Driver), an AI-based mobility tech company that delivers a safer driving experience, today announced the launch of its commercial fleet referral program, giving fleet managers, insurance brokers and existing commercial fleet users instant access to driving AI technology, telematics, HD video and cloud storage while unlocking a new revenue stream and potential discounts to clients.

Tarform Pushes Frontiers Of Everyday Electric Mobility With The Launch Of Its New $16,000 Vera Electric Bike

Responding to the strong demand for a higher-volume production model, Tarform is excited to introduce the Vera. Priced at $16,000, the Vera is engineered as an all-around street and scrambler motorcycle. It offers exhilarating performance with a 0-60 mph acceleration in 3.5 seconds, a top speed of 85+ mph, and a 100-mile range, all while maintaining a lightweight profile at 360 lbs.

The First Legal Writing Advisory Panel Unites Top Advocates and Judges to Reshape Standards

The Legal Writing Advisory Panel, the brainchild of Legal Writing Pro and BriefCatch founder and bestselling author Ross Guberman, is set to redefine legal writing for the next generation of law students, lawyers, and judges. The panel will align top names in legal writing with the broader legal community, crafting a future in which legal documents are more accessible, effective, and efficient than ever.