Welcome friends! Well, we’re not sure if two absolutely electric US gold medal hockey overtime wins over our friends to the north are an impossible act to follow, or if everyone’s lingering adrenaline highs will make just about any content sound good, but into the deep end we go.

It’s been a couple of quarters since our last VC/startup macro data check-in, so with final 2025 numbers now in, we figured it was time to stock of where things currently stand.

So while our poor Canadian readers lick their wounds after those hockey heartbreakers and our first ever Olympics curling scandal, let’s start our review of 2025 VC/startup trends with the fun part, the exit market (all data from the Pitchbook-NVCA Venture Monitor unless otherwise noted)…

A Demise Greatly Exaggerated

While this is not the first time we’ve covered the counternarrative strength in the startup exit market (with a historically favorable supply and demand imbalance), we’re now officially changing its designation from “encouraging signs” to “full-blown trend”.

Not only are we now in 3-year upward trend in both exit counts and dollar volumes, but hints of a meaningfull acceleration seen in early 2025 continued throughout the year. In terms of total exit value, M&A and PE buyout segments both had their second-highest year on record (just slightly below the 2021 bubble peak) and were 124% and 59% above 2023 lows, respectively.

The IPO market, of course, remained well under its 2021 peak (it may be a while before we see those levels again) and was still roughly 40% shy of 2019 and 2020 totals. That said, IPO volume in 2025 was 4x higher than 2023 lows and the fourth-best year on record in terms of total volume.

While the accelerating improvement in headline numbers is certainly a welcome development, what should really have us all excited is the underlying supply and demand trend that has aboslutely exploded in favor of startups and their VC backers (well, some of their VC backers, anyway). Absent any significant external shocks, this should lead to even more (and perhaps, even faster) improvements in these headline numbers over the next year or more.

Exceptional Demand Indications

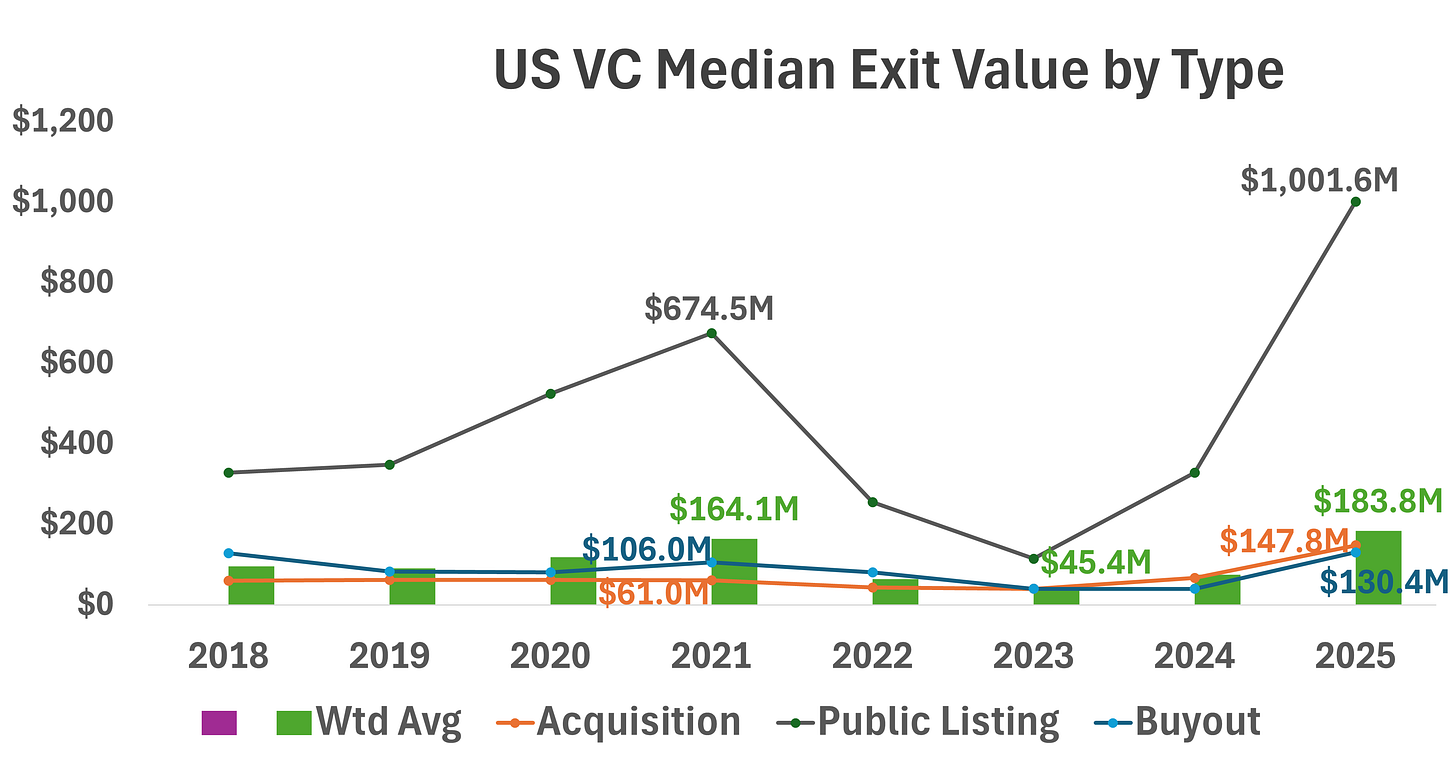

The most obvious indicator of the market’s willingness to buy mature tech startups (and not finding enough of them to buy) is, of course, skyrocketing exit valuations. Weighted average values are up 4.1x in just the last two years, and more than double the prior 10-year average (12% higher than even the 2021 peak!), and we’ve seen similar strength in each of Pitchbook’s three exit categories as well.

The median 2025 value for M&A exits (which generally make up 70-75% of all startup exits) were 2.7x above the trailing 10-year average (+2.2x YoY), PE buyouts were 1.6x their 10-year average and 3x last year, and IPO medians were 3.1x the 10-year and 3.3x last year, crossing the $1 billion mark for the first time (and a full 50% above their 2021 peak).

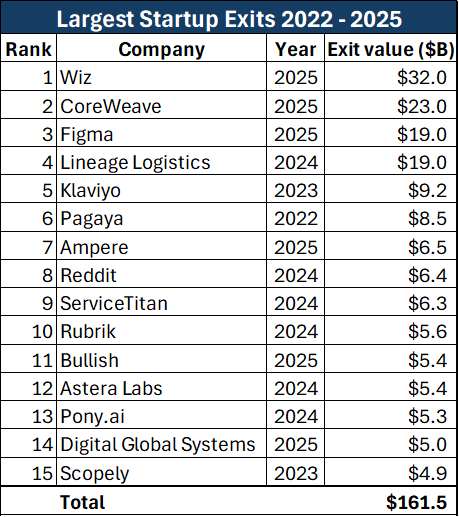

The breadth of this trend is perhaps even more encouraging. According to Crunchbase, there were 57 startup exits of $1 billion or more in 2025, behind only 2020 and 2021. 2025 was also a record year for $1 billion+ startup acquisitions (i.e., exits other than public listings) and acquistions as a share of total exits were second only to last year, nearly 3x their share of exits in 2021.

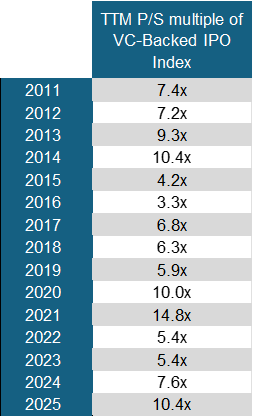

The IPO market also looks quite favorable in terms of revenue multiples, with trailing 12-month price-to-sales ratios for venture-backed IPOs at their second-highest annual average of the past decade-and-a-half, behind only 2021 (and 41% above the trailing 13-year average).

Continued Supply Constraints

Of course, demand is only half of the equation and a dearth of willing supply remains evident as well. While of course, we can’t know for sure what’s going on within late-stage funds, it’s not hard to infer from any number of dat points that despite record median exit prices, these portfolios’ remain littered with companies marked well above where they could exit today.

Steep Secondary Discounts

The vast majority secondary market clearing prices remain far below peak funding rounds. Price data from one of the major secondary platforms we look at has remained more or less the same for 3 years now — average prices right around 50% of prior funding rounds, more companies trading at 80%+ discounts than those trading at premiums to prior funding rounds, and those few premiums generally in the single-digit percentages.

IPO Loseses

Of the seven largest tech IPOs in 2025, five priced lower than the companies’ last private funding round (three saw losses for the last two funding rounds), and we’re talking about IPOs ranging from $6 billion to $23 billion. Furthermore, these final rounds were generally larger than all the prior rounds combined, so it’s likely they involved a huge percantage of the middle-of-the-alphabet fund set.

Incidentally, the early-stage investors in every one of these deals made an absolute killing — on the order of returning several multiples of their entire funds in one exit (we’re just saying…).

Stale Holdings

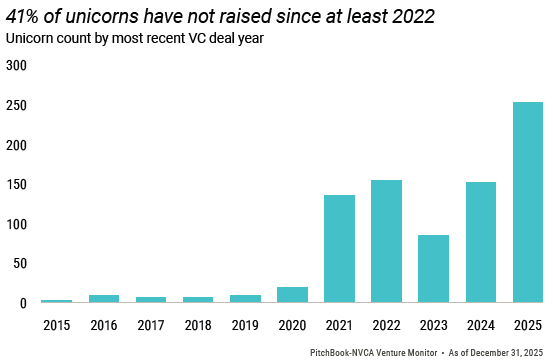

We’re also now at a historically low percentage of Series C+ deals from 2020-21 that have subsequently exited and 41% of all “unicorn” companies haven’t been back to the funding market since 2022.

Of course, this could mean that they abruptly shifted from every-9-months raise/burn cycles to growing super efficiently, and they just don’t need the capital. It could also mean they’d rather limp along indefinitely than raise a down round. We’ll let you decide.

Beginnings of a Spring (Portfolio) Cleaning?

This is admittedly a bit of reach but…

The aforementioned losses on giant IPOs, while disastrous for their late-stage backers, are good for the industry as a whole, freeing up capital to be reinvested in stages with better return profiles and more import to the overall ecosystem (read: Pe-Seed to Series A/B funds). If that’s where the recycled capital goes, that is (more on that below).

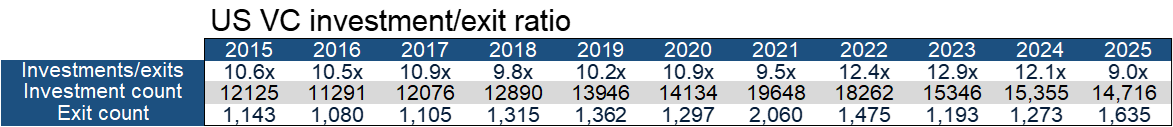

The ratio of new funding rounds to exits dropped dramatically in 2025, from a prior three-year average of 12.4x to 9.0x, a 10-year low, as exit counts have steadily climbed over the past 3 years, while new deal counts remain roughly flat.

So, we are at least heading back toward historical cashflow dynamics (if somewhat slowly).

Deal Activity

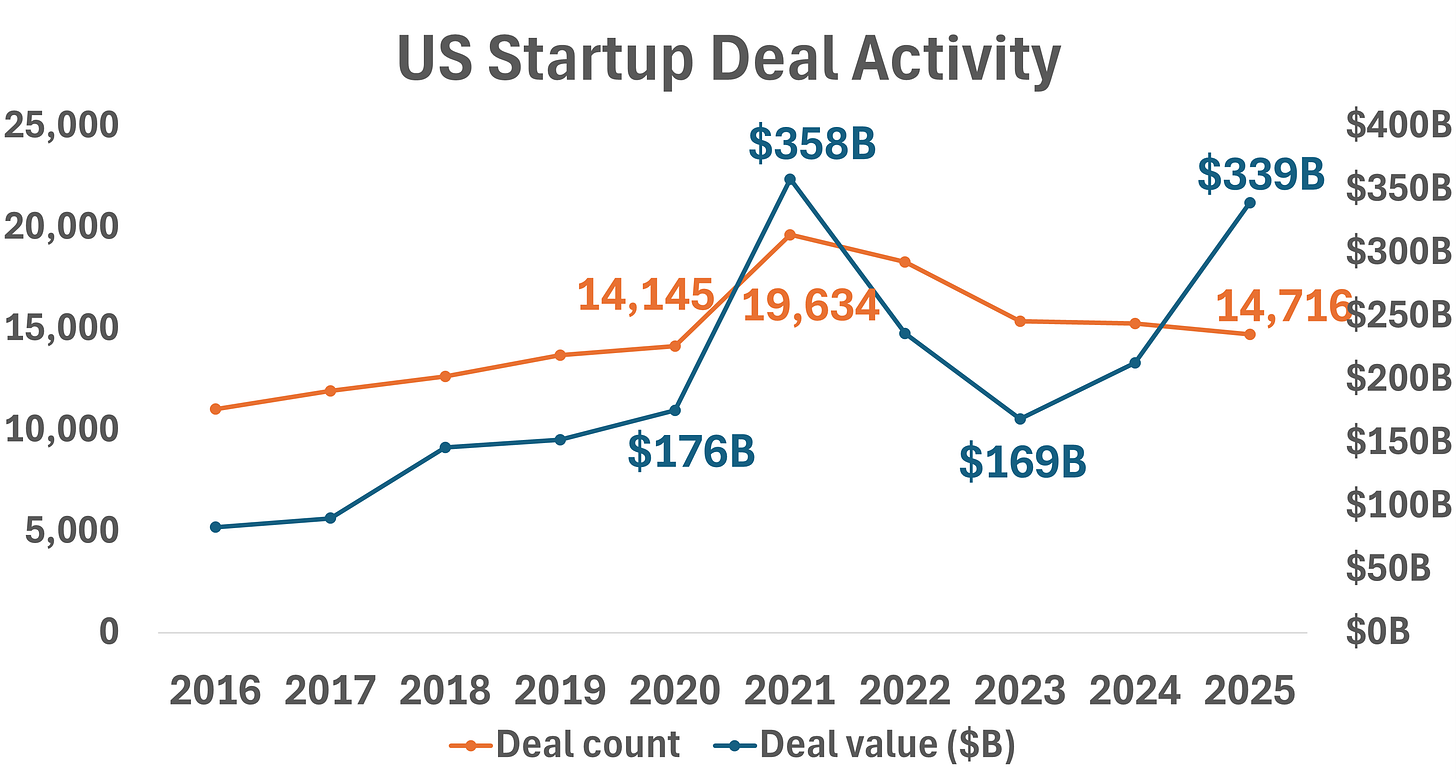

Despite (as noted above), the number of startup funding rounds remained more or less flat for a third year, total deal value roughly doubled year-over-year. This is, of course, due to the heavy late-stage VC concentration in Big AI companies that we have discussed in prior macro venture commentary, with 50% of 2025 startup funding going to just 0.05% of funding rounds (11 funding rounds made up 41% of all Q4 investment).

Valuation Reflation

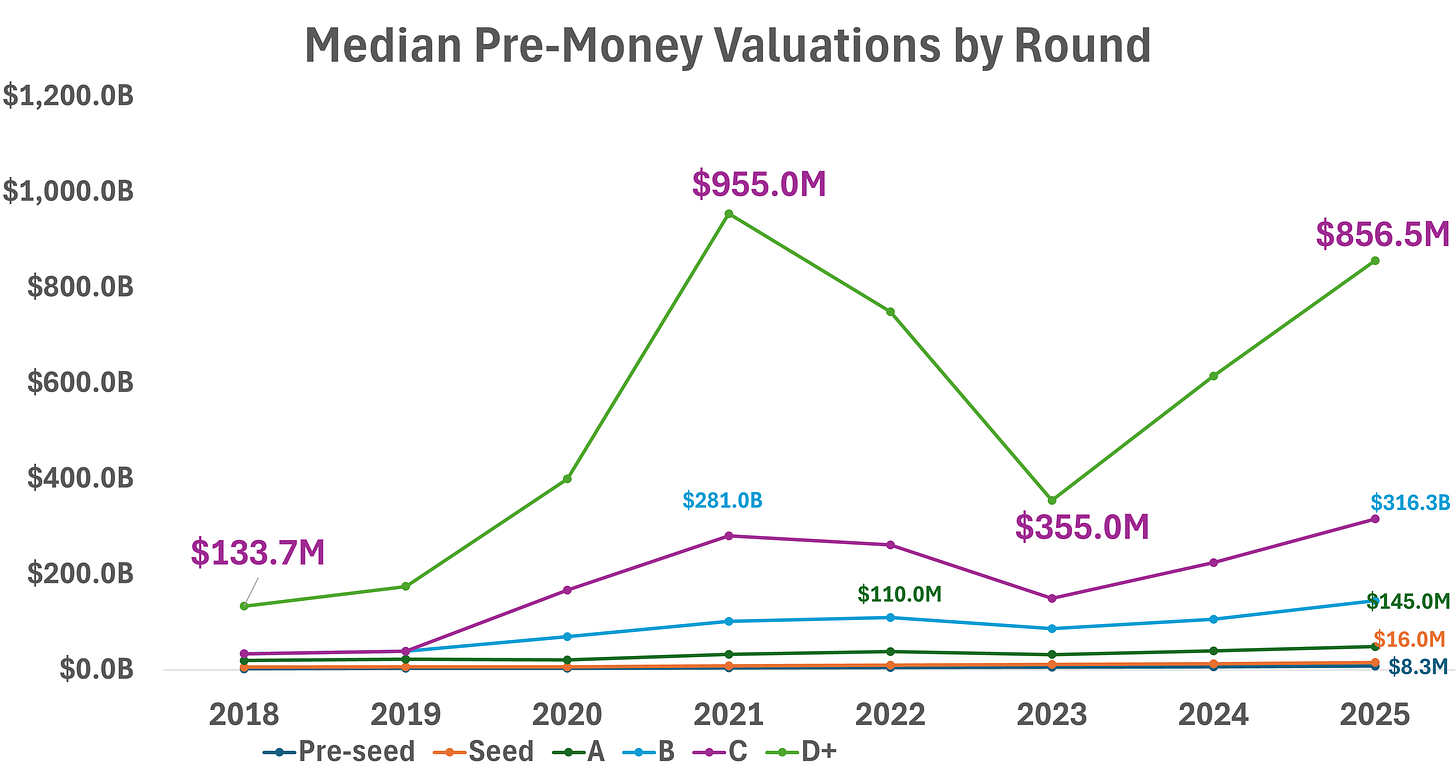

As one would expect, the combination of mostly flat deal counts and a spike in funding has sent valuations from Series A and beyond back to the 2021 stratosphere. As was the case then, the most extreme move has come in the super late-stage, with Series D+ median valuations now just shy of those 2021 peaks.

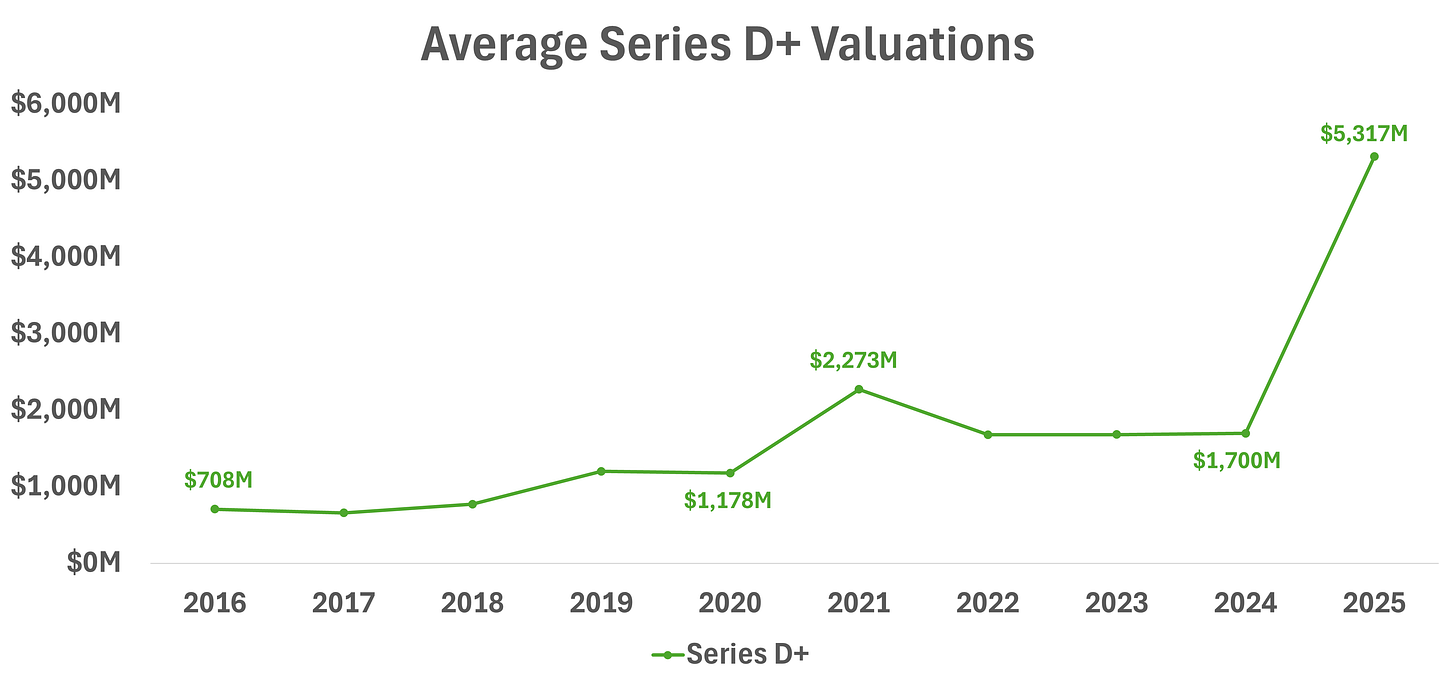

If anything, though, this may understate the current Series D+ environment, as average valuations in this segment (at $5.3 billion in 2025!) more than tripled YoY and were 2.3x their 2021 peak (which was, itself, double the prior high water mark).

To put this in context, in the past 6 years there have been a total of 18 VC-backed exits large enough to return 3x this funding round average, 10 that would have returned 5x, and 2 that would have returned 10x. In 2025, there were more than 1,000 Series D+ funding rounds.

So, just to recap:

From 2020 to 2022, median Series D+ valuations more than doubled, more doubled again, then plateaud (-20%), before a (very) brief reset.

In 2024 and 2025, there were more $5 billion-plus IPOs in which investors in the last one or more funding rounds (generally Series D or later) lost money than those in which they made money, and the average positive return was less than 3x.

We have a record number of $1 billion-plus startups (by a mile) unwilling or unable to either exit or raise new capital (presumably to avoid having to mark down those 2020-22 valuations on a realized or unrealized basis)

In 2025, Series D+ valuations have bounced right back to peak 2021 levels (if not well past those levels), only with a much (much, much) higher concentration in the highest priced companies.

Do with that what you will.

Last but definitely not least…

VC Fundraising Reset (Sort Of)

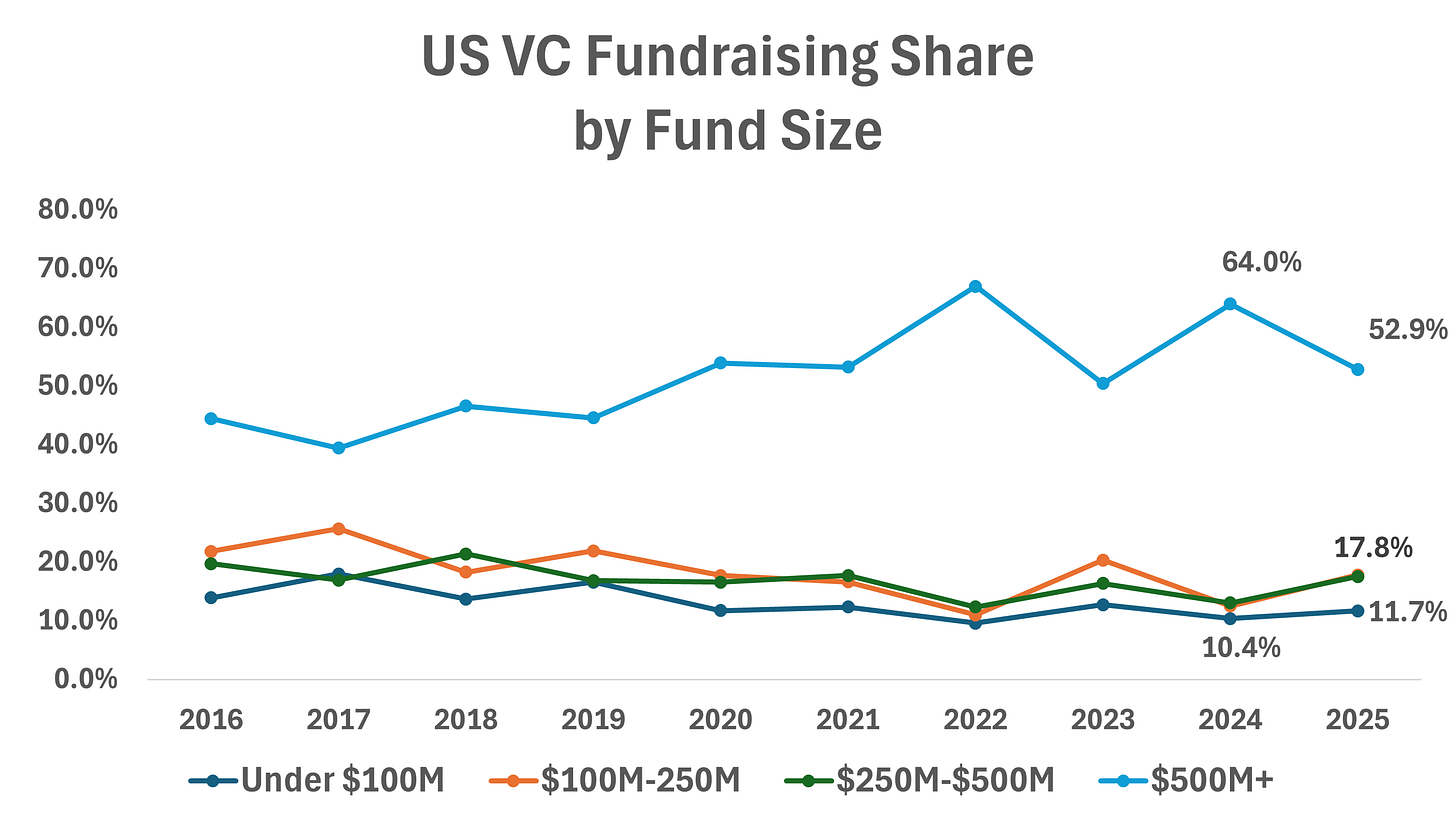

On the bright side, new mega-fund capital took a considerably smaller share of overall VC fundrasing in 2025, with that money distributed among every other size bucket (even the true early-stage, sub-$100mm segment!).

It’s a start, anyway. Let’s hope we can keep it up.

On the less bright side, despite a slight 2025 uptick in funding for emerging managers (those with fewer than four funds) relative to experienced managers, we remain in a 6-year trend of capital rotating away from newer VCs.

Remember when the core ethos of this sector was backing novel ideas, bold, outside-the-box thinking, and assymetric return profiles with exceptional upside? Sigh.

(Yes, we’re talking our own book here, but it doesn’t mean we’re wrong)

Matt sat down with Scott Kelly (Emerging Managers Podcast) to unpack C2 Ventures’ “dirty, dull, and dangerous” thesis — not because the startups are boring, but because the customer bases (manufacturing, healthcare, heavy industry, etc.) have been chronically under-invested in modern software and automation.

A few themes came through loud and clear: C2V backs early-stage SaaS and selective robotics where the customer ROI is obvious and immediate, and where founders typically lived the problem before building the solution. On robotics, Matt emphasized discrete use cases that reduce edge cases (he used Somatic’s autonomous commercial bathroom-cleaning robots as a great example) and was candid that “true autonomy” is still rare.

On AI, Matt’s take was refreshingly un-hypey: AI isn’t “the product,” it’s the engine (or a feature) inside software that mirrors real-world workflows for non-technical users. He also shared why C2V stays disciplined on valuations (even during bubble years) so the power-law math can actually work, plus a sharp perspective on why emerging managers and focused funds can outperform mega-funds that have to deploy huge checks at premium prices.

Avol raises $3.8M to deliver organs and blood to hospitals

St. Louis-based Avol Aerospace is using electric drones to transport urgent medical supplies like organs and blood to hospitals, and the startup's unique aircraft design can deliver these critical items up to 11 times faster than traditional methods for the same cost.

Operatory Subscription Model for Dental Practices

UptimeHealth (portfolio) teamed up with Dentalez and Darby to launch TotalOp — a subscription model that bundles key operatory equipment with monitoring, maintenance, and repairs into a single monthly fee.

The pitch: less upfront capex, fewer surprise breakdowns, and lower downtime, powered by UptimeHealth’s asset management platform and Dentalez’s predictive alerts.

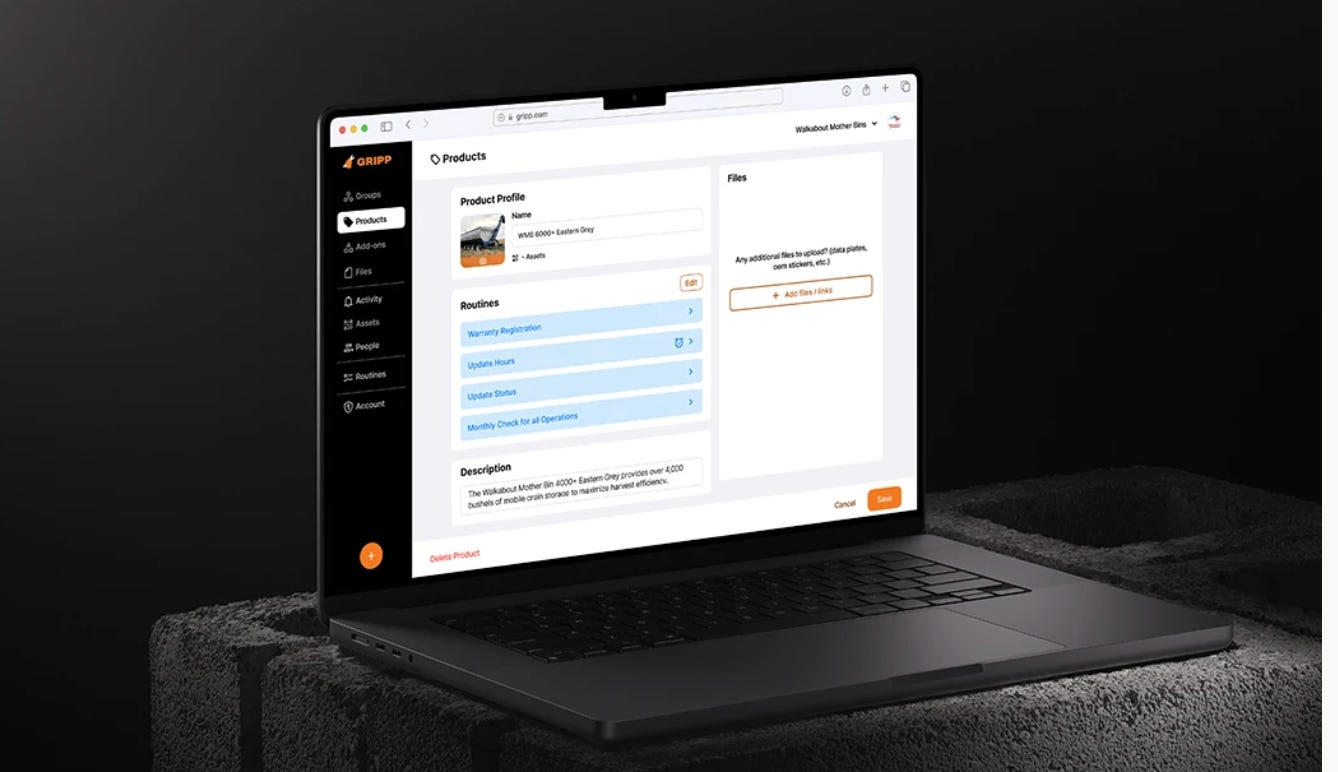

Getting a GRIPP on the Operation

Today’s farmers are constantly looking for ways to improve their operations, whether it’s new technology or ideas that have proven to help others. And recently at the Top Producer Summit held in Nashville, a company called GRIPP out of Wisconsin was there on behalf of AgLaunch of Tennessee to showcase how a simple idea is helping farmers keep better records.

How Two Years of Engineering Work Almost Killed Civ Robotics

Tom Yeshurun originally built the product around an aerial drone because it was technically exciting — then US customers immediately said, “Cool idea, but we’re afraid of drones. If it’s a ground robot, we’ll buy.” He scrapped the work and rebuilt it for autonomous ground robots.

The bigger mistake: early validation happened in Israel/Europe, where surveying is often subcontracted — but in the US, EPCs/GCs frequently do it in-house, so the buyer, ROI, and sales motion were totally different.

Now Civ runs on a simple rule: 1 customer asks → log it. 2 ask → build it. 3 ask → should already be done. Customer pull beats engineering push.

BriefCatch Just Announced They’ve Acquired WordRake.

WordRake has been a go-to editing tool for years, especially inside Microsoft Word, for lawyers and other pros who care about clarity and concision. The logic here is clean: combine WordRake’s sentence-level editing with BriefCatch’s document-level analysis (structure, strategy, persuasion) to help legal teams write tighter briefs and stronger arguments.

Eden has two open roles